Blog Archives

San Antonio Area Home Prices Continued Rising in October

The San Antonio area continued to see an increase in average and median home prices in October, despite a decrease in the number of homes sold, according to the October 2022 Multiple Listing Service (MLS) Report from the San Antonio Board of REALTORS® (SABOR).

Average and Median Home Prices The average price of a home sold in the San Antonio area in October was $382,518, which is an 8% increase over October 2021. The median price homes sold for in October was $323,190, which is also an 8% increase over the October 2021 median price.

However, the number of single-family homes that sold in the San Antonio area in October was 19% lower than the number of homes sold in October 2021 with 2,656 homes sold.

Average sold price per square foot was $183, which is percent 11% higher than one year ago.

Inventory and Days on Market – In October, single family homes in the San Antonio area stayed on the market for an average of 44 days compared to an average of 29 days in October 2021.

The month of October ended with 10,390 listings on the market including 3,978 new listings. The month ended with 2,179 sales pending.

Condominium and Townhomes – The number of Condominium and townhomes sold in October was 29% lower than October 2021 with 59 units sold. The average sold price of condos and townhomes, at $266,873 was 14% fourteen percent higher than October 2021Condominiums and townhomes stayed on the market for an average of 54 days in October.

Housing Inventory – The San Antonio area had only 3.2 months of housing inventory available in October. A supply of six months of inventory is considered to be a balanced market, so we are still in a Sellers’ market.

With housing inventory increasing, home buyers are regaining some negotiating power. Even though it’s still a seller’s market, today buyers have less competition and more negotiating power.

Residential Lots & Acreage – The number of residential lots and acreage properties sold in the San Antonio area in October was 27% (twenty seven percent) lower than October 2021, with 267 lots sold. However, the average price of lots increased to $149,061 (one hundred forty nine thousand, sixty one dollars) a 9% increase compared to one year ago. Lots and acreage properties spent an average of only 62 days on the market in October, which is 11% less time on the market compared to the average number of days that they spent on the market than in October 2021.

Rural Farms and Ranches – The number of Rural Farms and Ranches sold in October was 48% lower than October 2021. The average price of rural farm and ranch properties that sold was $1,145,268 (one million, one hundred forty five thousand, two hundred sixty eight dollars) which was 14% higher than the average price of farm and ranch properties that sold in October 2021.

Keeping Things in Perspective – If you are a home buyer contemplating a move but wondering how and why to buy a home amidst rising interest rates, here are a few things to consider.

While interest rates have increased from their historic lows, they are still far below where they have been in recent decades.

Despite rising interest rates, there are many mortgage programs, builder promotions, down payment assistance programs and creative financing strategies available to help home buyers get into a home with a more affordable monthly payment.

While some homebuyers have been watching and waiting for prices to fall, waiting could be costly. If you are ready and able to buy a home now, it makes more sense to get into a home of your own, start building equity and net worth and enjoying the other benefits of being a homeowner.

As Odeta Kushi, Deputy Chief Economist at First American stated,

“If you can find a house that meets your financial expectations for a monthly payment and it’s a good time to buy, then do that…And if you wait for prices to fall, but they never do, you may discover the hard way that the house you found a year ago that you really loved that you could afford but you passed up on, is more expensive next year.”

In this real estate market it pays to make sure that you are informed about the local market, rates and options available to you to make smart financial moves. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

Will My House Still Sell in Today’s Market?

If recent headlines about the housing market cooling and buyer demand moderating have you worried you’ve missed your chance to sell, here’s what you need to know.

Buyer demand hasn’t disappeared, it’s just eased from the peak intensity we saw over the past two years.

Buyer Demand Then and Now

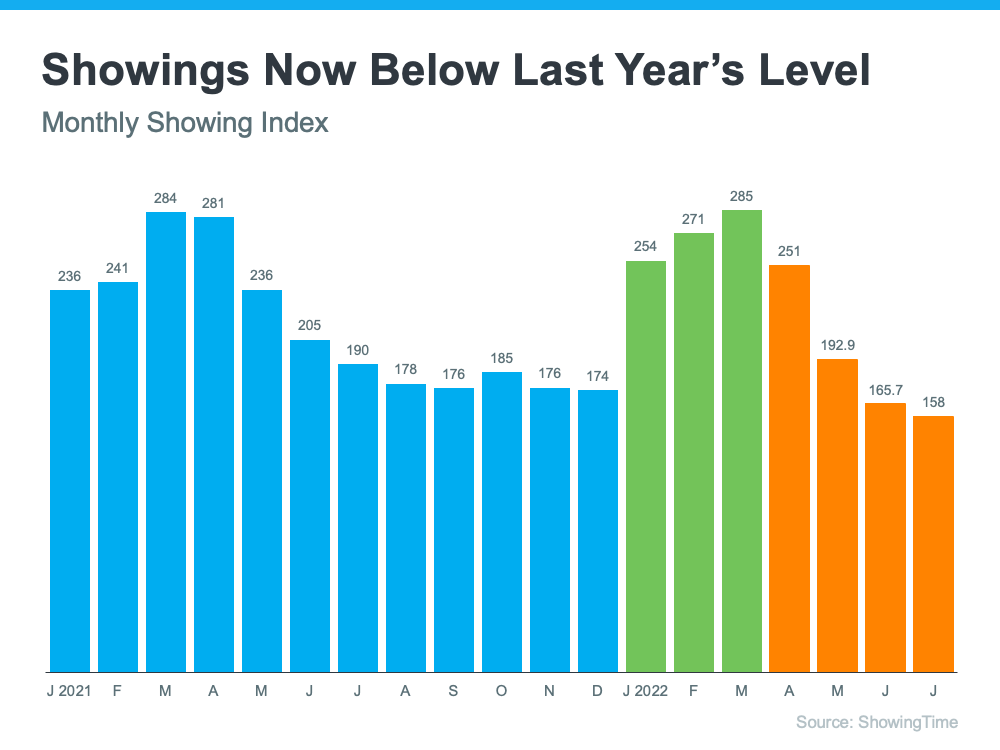

During the pandemic, mortgage rates hit record lows, and that spurred a significant rise in buyer demand. This year, as rates increased due to factors like rising inflation, buyer demand pulled back or softened as a result. The latest data from ShowingTime confirms this trend (see graph below):

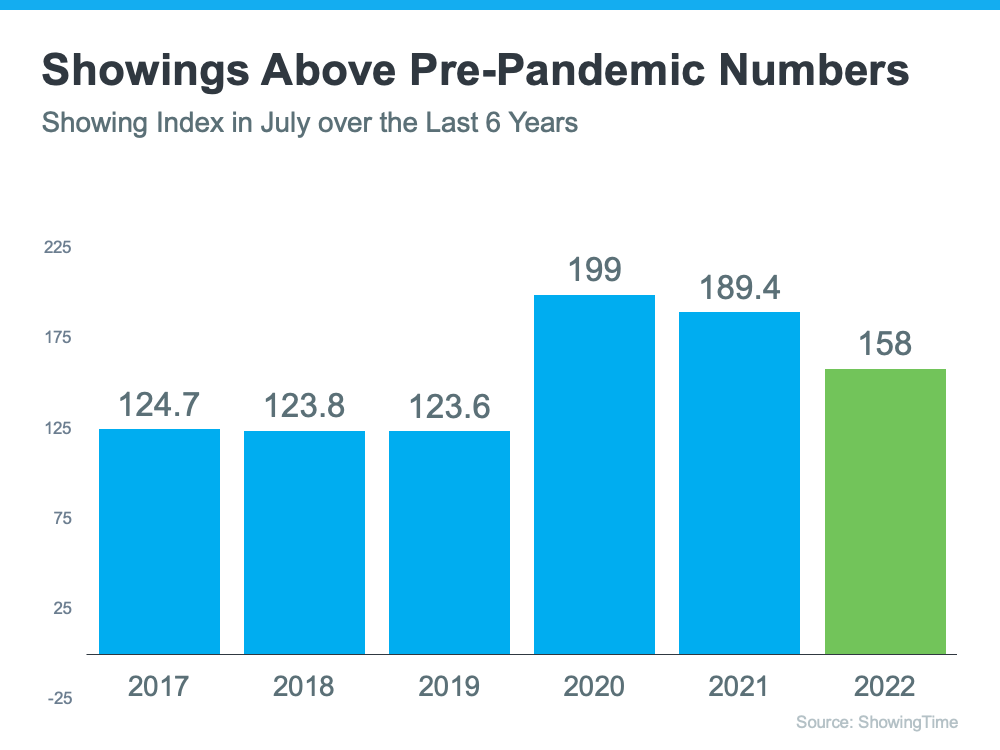

The orange bars in the graph above represent the last few months of data and the clear cooldown in the volume of home showings the market has seen since mortgage rates started to rise. But context is important. To get the full picture of where today’s demand stands, let’s look at the July data for the past six years (see graph below):

This second visual makes it clear that, while moderating compared to the frenzy in 2020 and 2021, showing activity is still beating pre-pandemic levels – and those pre-pandemic years were great years for the housing market. That goes to show there’s still demand if you sell your house today.

What That Means for You When You Sell

The key to selling in a changing market is understanding where the housing market is now. It’s not the same market we had last year or even earlier this year, but that doesn’t mean the opportunity to sell has passed.

While things have cooled a bit, it’s still a sellers’ market. If you work with a trusted local expert to price your house at the current market value, the demand is still there, and it should sell quickly. According to a recent survey from realtor.com, 92% of homeowners who sold in August reported being satisfied with the outcome of their sale.

Bottom Line

Buyer demand hasn’t disappeared, it’s just moderated this year. If you’re ready to sell your house today, let’s connect so you have expert insights on how the market has shifted and how to plan accordingly for your sale.

Why It’s Still a Seller’s Market

As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is still anything but normal.

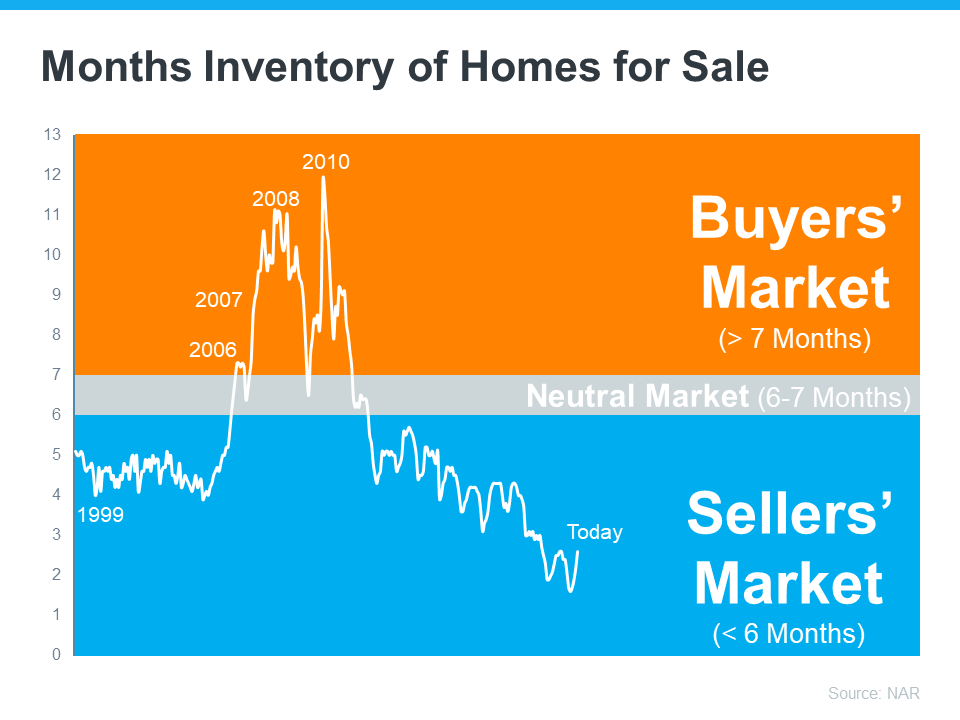

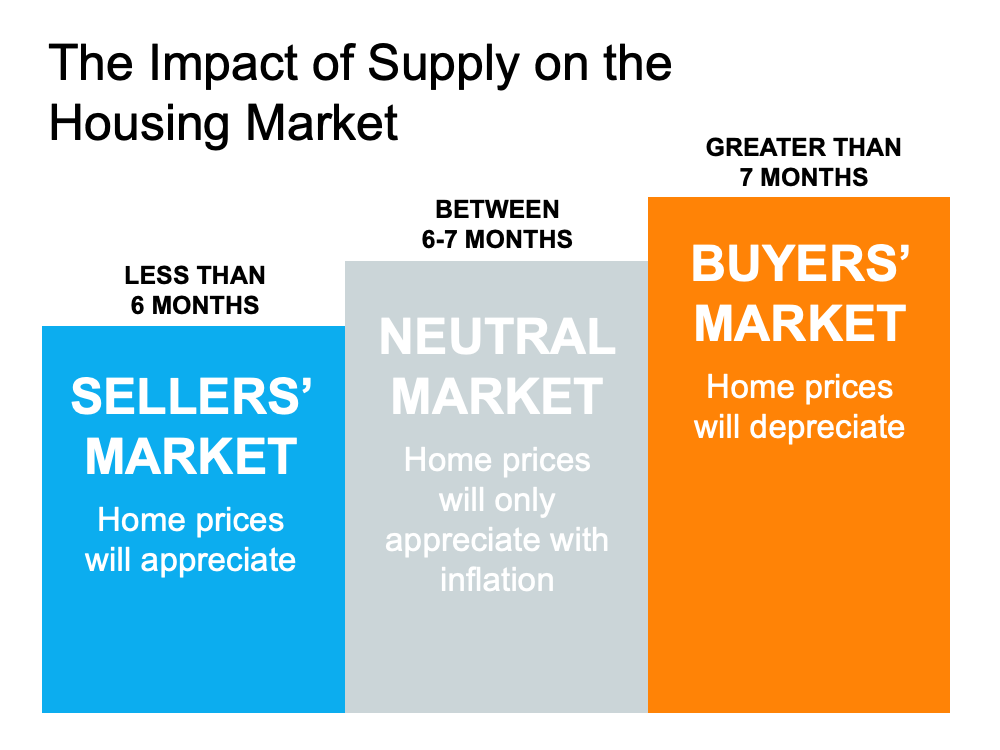

Even though the supply of homes for sale has been growing this year, there’s still a shortage of homes on the market. And that means conditions continue to favor sellers today. That’s because the level of inventory of homes for sale can help determine if buyers or sellers are in the driver’s seat. Think of it like this:

- A buyers’ market is when there are more homes for sale than buyers looking to buy. When that happens, buyers have the negotiation power because sellers are more willing to compromise so they can sell their house.

- In a sellers’ market, it’s just the opposite. There are too few homes available for the number of buyers in the market and that gives the seller all the leverage. In that situation, buyers will do what they can to compete for the limited number of homes for sale.

- A neutral market is when supply is balanced and there are enough homes to meet buyer demand at the current sales pace.

And for the past two years, we’ve been in a red-hot sellers’ market because inventory has been near record lows. The blue section of this graph highlights just how far below a neutral market inventory still is today.

What Does This Mean for You?

Ed Pinto, Director of the American Enterprise Institute’s Housing Center, gives a perfect summary of what’s happening in today’s market, saying:

“Overall, the best summary is that we’ll move from a gangbuster sellers’ market to a modest sellers’ market.”

Conditions are still in your favor even though the market is cooling. If you work with an agent to price your house at market value, you’ll find success when you sell your house today. While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed.

Bottom Line

Today’s housing market still favors sellers. If you’re ready to sell a home in the San Antonio area, let’s connect so you can start making your moves.

San Antonio Home Prices Continued Double Digit Increases in April Amidst Low Inventory

San Antonio area home prices continued their strong upward trend in April amidst record low inventory and strong home buyer demand.

Single Family Home Sales – The number of single family homes sold in the San Antonio area in April was 8% lower than the number of homes sold in April 2021, with 3,255 homes sold, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report. Home prices continued their strong upward trend in April. The average price of a home sold in the San Antonio area in April was $395,847, a 20% increase over April 2021. The median price homes sold for in April was $338,700, a 23% increase over the April 2021 median price.

Average Days on Market – In April, single family homes in the San Antonio area stayed on the market for an average of only 31 days compared to an average of 38 days in April 2021, so homes sold 18% faster than one year ago.

Average Sold Price Per Square Foot – Average sold price per square foot was $188, which is 23% higher than in April 2021.

Condos and Townhomes – The number of Condominium and townhome sales, with 96 units sold, was 2% two percent higher than the number of units sold last April. The average sold price of condos and townhomes, at $267,219, which was 30% higher than April 2021. Condominiums and townhomes stayed on the market for only 37 days in April, compared to 78 days one year ago, so condos and townhomes sold fifty three percent 53% faster than last April.

Housing Inventory – The month of April ended with 4,800 listings on the market including 4,260 new listings. The month ended with 3,290 three thousand, two hundred ninety sales pending.

The San Antonio area had only 1.2 months of housing inventory available in April, which is the same inventory that was available in March. A supply of six months of inventory is considered to be a balanced market, so we are still in a very strong Sellers’ market.

If you have been thinking of moving into the home of your dreams or downsize into something that better suits your current needs, you have an opportunity to get ahead of the curve by leveraging your growing equity and purchasing your next home before prices climb higher.

Lots and Acreage – The number of residential lots and acreage properties sold in April was 23% lower than April 2021, with 434 lots sold compared to the 560 five hundred sixty that sold in April 2021. However, the average price of lots increased to $164,026, a 25% increase compared to one year ago. Lots and acreage properties spent an average of only 88 days on the market in April, which is 40% percent less time on the market compared to the average of 147 days that they spent on the market than in April 2021.

Farm and Ranch – The number of Rural Farms and Ranches sold in April was 8% eight percent lower than April 2021, with 68 sixty eight farms and ranches sold compared to 63 sixty three that sold one year ago. The average price of rural farm and ranch properties that sold was $4,374,663 which was 348% percent higher than the average price of farm and ranch properties that sold in March twenty twenty one 2021

If you thinking of buying or selling a home in the San Antonio area, and want to work with a trusted professional throughout the process, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

San Antonio Area Saw Double Digit Home Price Increases in December 2021

San Antonio Real Estate Market Update

Single Family Homes Sold December 2021 – The number of single homes sold in the San Antonio area in December was just 1% less than the number of homes sold in December 2020, with 3,529 home sold, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report. Despite the slight decrease in the number of homes sold in December, all other signs indicate that home buyer demand is still very strong. Single family homes in the San Antonio area stayed on the market for an average of only 34 days in December compared to an average of 49 days in December 2020, so homes sold thirty one percent 31% faster than one year ago.

Average & Median Home Prices – Home prices also continued their strong upward trend in December. The average price of a home sold in the San Antonio area in December was $363,075, a 15% increase over December 2020. The median price homes sold for in December was $311,000, a 19% increase over the December 2020 median price.

Average sold price per square foot was $173, which is 20% higher than in December 2020.

Condos and Townhomes – The number of Condominium and townhome sales increased by 14% in December with 92 units sold. However, the average sold price of condos and townhomes, at $245,858 was 20% lower than December 2020. Condominiums and townhomes stayed on the market for only 52 days in December, compared to 94 days one year ago, so condos and townhomes sold 45% faster than last December.

Housing Inventory – The month of December ended with 4,867 listings on the market including 2,784 new listings. The month ended with 2,642 sales pending. The San Antonio area had only 1.4 months of housing inventory available in December, which is down slightly from the 1.6 months that was available in November. A supply of six months of inventory is considered to be a balanced market, so we are still in a very strong Sellers’ market.

With such low housing inventory, strong home prices and strong buyer demand this could be the best time for home owners to list their homes for sale.

Home Equity Increases – CoreLogic,’s CoreLogic’s third quarter home equity report showed that the average homeowner with a mortgage gained $57,000 in equity over the past year. This is a great time for sellers to take advantage of low interest rates and make a move by using this equity to move up, downsize or find a home that better suits their needs.

New Options for Sellers to Buy a Home While Selling a Home – If you have been thinking of selling your home but are wondering how to buy your next home while selling your current home or have renovations or improvements that need to be done prior to selling your home, there are several new programs that can help home sellers to make a move in this market. These options range from cash offers for sellers that want to sell as-is, access to financing for renovations to fix up and sell their home for top dollar and a new program available in the San Antonio area, called Knock Home Swap which helps home sellers to buy and move into to their next home, before selling their current home!

Mortgage Interest Rates – Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this past year with rates close to three percent 3% for a 30-year mortgage loan. However, Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will be gradually increasing over the next few months. However, rates are starting to rise, but that doesn’t mean you’ve missed out on locking in a low rate.

Current mortgage rates are still far below what they’ve been in recent decades: In the 2000s, the average mortgage rate was 6.27%, and in the 1990s, the average rate was 8.12%. So even with mortgage rates rising closer to 4%, they’re still worth taking advantage of. You just want to do so sooner rather than later. Experts are projecting rates will continue to rise throughout this year, and when they do, it’ll cost you more to purchase your next home.

Residential Lots and Acreage – The number of residential lots and acreage properties sold in December was almost the same as this time last year, with 372 lots sold compared to the 373 that sold in December 2020. However, the average price of lots increased to $152,343, a 23% increase compared to one year ago. Lots and acreage properties spent an average of only 91 days on the market in December, which is 45% less time on the market compared to the average of 166 days that they spent on the market than in December 2020.

Rural Farms and Ranches – The number of Rural Farms and Ranches sold in the San Antonio area in December was 30% higher than December 2020, with 78 farms and ranches sold. The average price of rural farm and ranch properties that sold was $1,449,538, which was 52% higher than the average price of farm and ranch properties that sold in December 2020.

Moving Ahead – We are expecting that 2022 will be another strong year for real estate. Whether you are looking to buy the home of your dreams, sell a home or invest in real estate to build long term wealth, it pays to work with a trusted real estate professional throughout the process. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

*Percentage increases are based on a year-over-year comparison of December 2021 in comparison with December 2020. San Antonio market data provided by San Antonio Board of REALTORs

Why Now Is a Great Time To Sell Your House

As we near the end of the year, more homeowners are realizing the benefits of today’s sellers’ market.

Record-breaking home price appreciation, growing equity, low inventory, and competitive mortgage rates are motivating homeowners to make a move that addresses their changing lifestyles.

In fact, recent data from realtor.com shows a larger share of homeowners are planning to list their houses this winter. So, that means more homes are about to hit the market, which will lead to more choices for buyers too.

According to George Ratiu, Manager of Economic Research at realtor.com:

“The pandemic has delayed plans for many Americans, and homeowners looking to move on to the next stage of life are no exception. Recent survey data suggests the majority of prospective sellers are actively preparing to enter the market this winter.“

If you’re thinking of waiting until the spring to sell your house, know that your neighbors may be one step ahead of you by selling this winter. If you want to stand out from the crowd, this holiday season is the best time to make sure your house is available for buyers. Here’s why.

Sellers Are Still Firmly in the Driver’s Seat

Historically, a 6-month supply of homes for sale is needed for a normal or neutral market. That level ensures there are enough homes available for active buyers (see graph below):The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows the inventory of houses for sale sits at a 2.4-month supply. The level of inventory of homes for sale in the San Antonio area was only 1.7 months in October 2021. This is well below a neutral market.

What Does That Mean for You?

When the supply of homes for sale is as low as it is today, it’s much harder for buyers to find homes to purchase. This drives up competition among buyers, who then submit increasingly competitive offers to win out against others in the home search process. As this happens, prices rise and your leverage as a seller rises too, putting you in the best position to negotiate a contract that meets your ideal terms.

And while the low housing supply we’re facing won’t be solved overnight, sellers this season should move quickly to maximize their potential. As the data shows, with more prospective sellers planning to list their homes this winter, selling sooner rather than later helps your house rise to the top of a holiday buyer’s wish list so you can close the best possible deal.

Bottom Line

Listing your home over the next few weeks gives you the best chance to be in front of buyers competing for homes this holiday season. Let’s connect today to discuss how you can benefit from today’s sellers’ market.

If you are thinking of buying or selling a home in the San Antonio metropolitan area, and want to work with a trusted San Antonio REALTOR® throughout the process, contact Trudy Edwards of KELLER WILLIAMS Realty Heritage, at (210) 595-9801, or by email at TrueSARealEstate@gmail.com.

Sellers Have Incredible Leverage in Today’s Market

With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year.

Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), puts it best, saying:

“Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year.”

But the sense of urgency they feel is complicated by the lack of homes for sale in today’s market. According to the latest Existing Home Sales Report from NAR:

“From one year ago, the inventory of unsold homes decreased 13%. . . .”

What Does This Mean for Sellers Today?

With buyers eager to purchase but so few homes available, sellers who list their houses this fall have a tremendous advantage – also known as leverage – when negotiating with buyers. That’s because, in today’s market, buyers want three things:

- To be the winning bid on their dream home.

- To buy before rates rise

- To buy before prices go even higher.

Your Leverage Can Help You Negotiate Your Best Terms

These three buyer needs give homeowners a leg up when selling their house. You might already realize this leverage enables you to sell at a good price, but it also means you can negotiate the best terms to suit your needs.

And since buyer demand is still high, there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, look closely at the terms of each offer to find out which one has the best perks for you.

If you have questions about what’s best for your situation, your trusted real estate advisor can help. They have the expertise and are skilled negotiators in all stages of the sales process.

Bottom Line

Today’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling a home. Let’s connect today to discuss how much leverage you have as a seller in today’s San Antonio area market.

Is This the Year to Sell My House?

If one of the questions you’re asking yourself is, “Should I sell my house this year?” consumer sentiment about selling today should boost your confidence in the right direction

Even with the current health crisis that continues to challenge our nation, Americans still feel good about selling a house. Here’s why.

According to the latest Home Purchase Sentiment Index from Fannie Mae, 57% of consumer respondents to their survey indicate now is a good time to buy a home, while 59% feel it’s a good time to sell one:

“The percentage of respondents who say it is a good time to sell a home remained the same at 59%, while the percentage who say it’s a bad time to sell decreased from 35% to 33%. As a result, the net share of those who say it is a good time to sell increased 2 percentage points month over month.”

As you can see, many still believe that, despite everything going on in the world, it is still a good time to sell a house.

Why is now a good time to sell?

There simply are not enough homes available to meet today’s buyer demand, and they’re selling just as quickly as they’re coming to the market. According to the National Association of Realtors (NAR), unsold inventory available today sits at a 2.3-month supply at the current sales pace, which is down from a 2.5-month supply from the previous month. This record-low inventory is not even half of what we need for a normal or neutral housing market, which should have a 6.0-month supply of unsold inventory to balance out.

With so few homes available for buyers to choose from, we’re in a true sellers’ market. Homeowners ready to make a move right now have the opportunity to negotiate the best possible contracts with buyers who are feeling the pull of intense competition when it comes to finding their dream home. Lawrence Yun, Chief Economist for NAR, notes how quickly homes are selling right now, further confirming the benefits to sellers this season:

“The market is incredibly swift this winter with the listed homes going under contract on average at less than a month due to a backlog of buyers wanting to take advantage of record-low mortgage rates.”

However, this sweet spot for sellers won’t last forever. As more homes are listed this year, this tip toward sellers may start to wane. According to Danielle Hale, Chief Economist at realtor.com, more choices for buyers are on the not-too-distant horizon:

“The bright spot for buyers is that more homes are likely to become available in the last six months of 2021. That should give folks more options to choose from and take away some of their urgency. With a larger selection, buyers may not be forced to make a decision in mere hours and will have more time to make up their minds.”

Bottom Line

If you’re ready to make a move, you can feel good about the current sentiment in the market and the advantageous conditions for today’s sellers. Let’s connect today to determine the best next step when it comes to selling your house this year.