Blog Archives

San Antonio Home Prices Saw Double Digit Increases Amidst Record Low Inventory in March

With fast moving home sales and low inventory of available homes for buyers to choose from, San Antonio area home prices saw double digit price increases in March

Average and Median Home Prices – The average price of a home sold in the San Antonio area in March was $374,168, which was a 19% increase over March 2021. The median price homes sold for in March was $326,500, a 22% increase over the March 2021 median price, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report. Average sold price per square foot was $183, which is percent 24% higher than in March 2021.

Inventory and Days on Market – The number of single family homes sold in the San Antonio area in March was 1% higher than the number of homes sold in March 2021, with 3,522 homes sold. In March, single family homes in the San Antonio area stayed on the market for an average of only 34 days compared to an average of 45 days in March 2021, so homes sold 24% faster than one year ago. The month of March ended with 4,258 listings on the market including 3,782 new listings. The month ended with 3,432 sales pending.

The San Antonio area had only 1.2 months of housing inventory available in March, which is up slightly from the 1 month of inventory that was available in February. A supply of six months of inventory is considered to be a balanced market, so we are still in a very strong Sellers’ market.

With such low housing inventory, strong home prices and strong buyer demand this is still a great time for home owners to list their homes for sale and make a move.

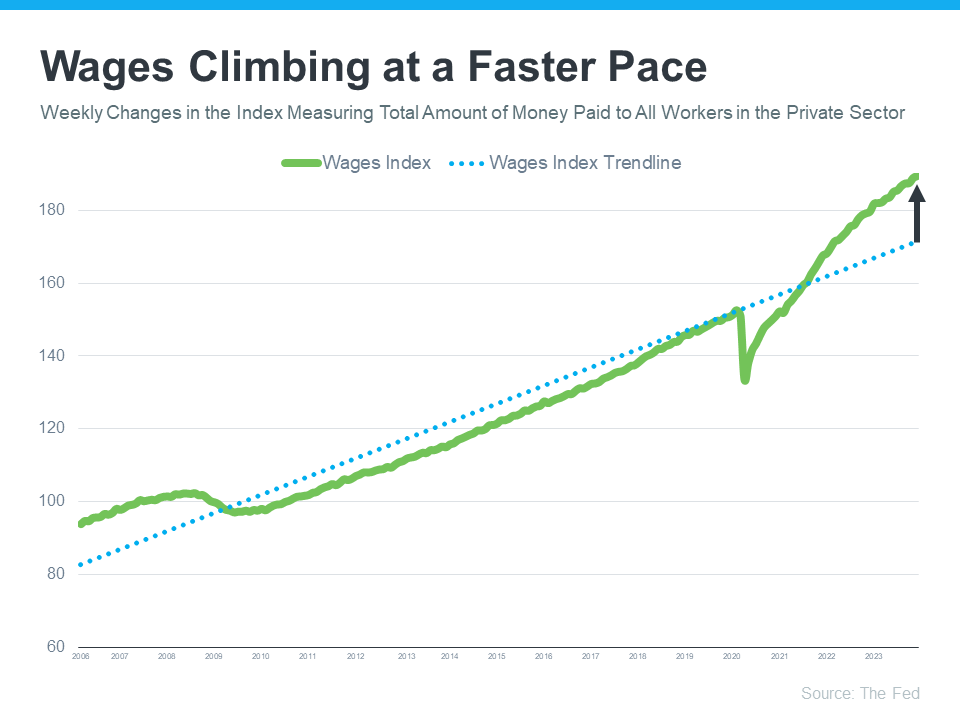

If you are a homeowner and have been thinking of moving into the home of your dreams or downsizing into a home that better suits your current needs, you have an opportunity to get ahead of the curve by leveraging your growing equity and purchasing your next home before prices and rates climb higher.

Rising Rates – Interest Rates on a 30 year mortgage recently edged up over 5%. On April 21st the Average interest rate on a 30 mortgage was reported at 5.11% per Freddie Mac.

If you’re thinking of moving this year, with mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of delaying your plans, today’s rates should motivate you to purchase now before rates increase more. Use that motivation to energize your search and plan your next steps accordingly.

While it’s true rising mortgage rates and home prices mean buying a house today costs more than it did a year ago, you still have an opportunity to set yourself up for a long-term win. Buying now lets you lock in at today’s rates and prices before both climb higher.

In inflationary times, it’s especially important to invest your money in an asset that traditionally holds or grows in value. Home price appreciation outperformed inflation in most decades going all the way back to the seventies – making homeownership a historically strong hedge against inflation.

Condominium and Townhomes – The number of Condominium and townhome sales was the same as one year ago with 92 units sold. However, the average sold price of condos and townhomes, at $231,166 was 3% lower than March 2021. Condominiums and townhomes stayed on the market for only 52 days in March, compared to 64 days one year ago, so condos and townhomes sold nineteen percent 19% faster than last March.

Residential Lots & Acreage – The number of residential lots and acreage properties sold in March was 7% lower than 2021, 515 lots sold compared to the 556 that sold in March 2021. However, the average price of lots increased to $166,042 a 35% increase compared to one year ago. Lots and acreage properties spent an average of only 81 days on the market in March, which is 59% less time on the market compared to the average of 196 days that they spent on the market than in March 2021.

Rural Farms and Ranches – The number of Rural Farms and Ranches sold in March was 20% lower than March 2021, with 68 farms and ranches sold compared to 85 sold one year ago. The average price of rural farm and ranch properties that sold was $1,125,167 which was 50% higher than the average price of farm and ranch properties that sold in March 2021.

Mike Simonsen from Altos Research recently remarked – “We keep watching for it, but there are absolutely no signs of market slowdown anywhere in the data. If anything we’re seeing the market continue to heat up.”

In this competitive market, it pays to work with a trusted professional to help you achieve your real estate goals. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

*Percentage increases are based on a year-over-year comparison of March 2022 in comparison with March 2021. San Antonio market data provided by San Antonio Board of REALTORs

With Mortgage Rates Climbing, Now’s the Time To Act

Last week, the average 30-year fixed mortgage rate from Freddie Mac jumped from 3.22% to 3.45%. That’s the highest point it’s been in almost two years. If you’re thinking about buying a home, this news may have come as a bit of a shock. But the truth is, it wasn’t entirely unexpected

Experts have been calling for rates to rise in their 2022 projections, and the forecast is now becoming a reality. Here’s a look at the projections from Freddie Mac for this year:

- Q1 2022: 3.4%

- Q2 2022: 3.5%

- Q3 2022: 3.6%

- Q4 2022: 3.7%

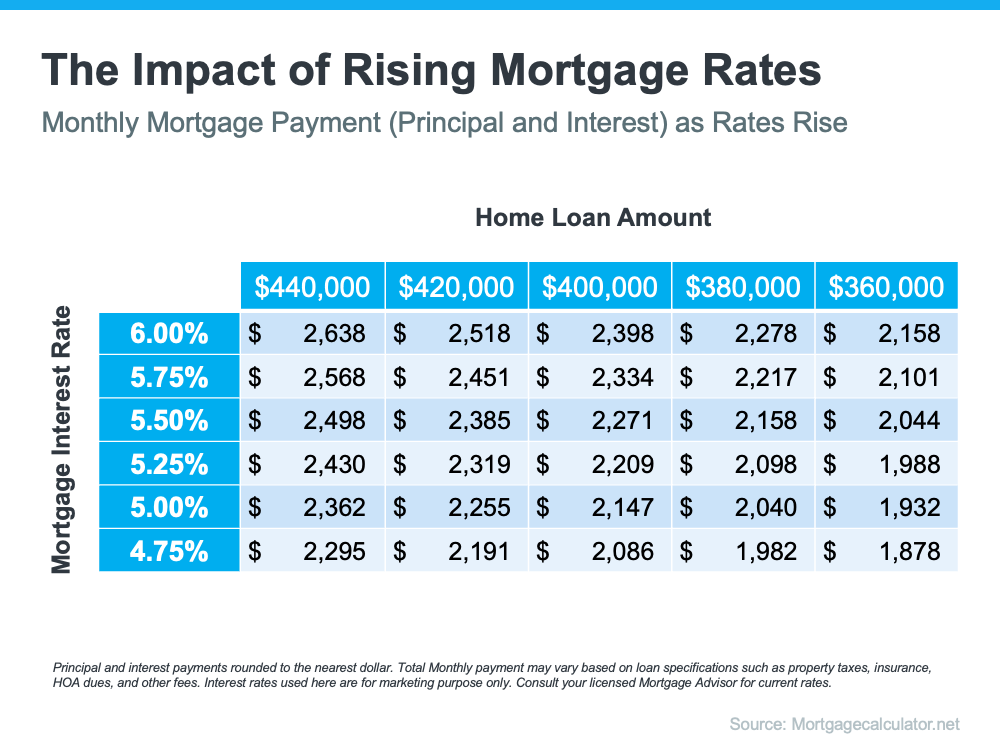

As the numbers show, this jump in rates is in line with the expectations from Freddie Mac. And what they also indicate is that mortgage rates are projected to continue climbing throughout the year. But should you be worried about rising mortgage rates? What does that really mean for you?

As rates increase even modestly, they impact your monthly mortgage payment and overall affordability. If you’re looking to buy a home, rising mortgage rates should be an incentive to act sooner rather than later.

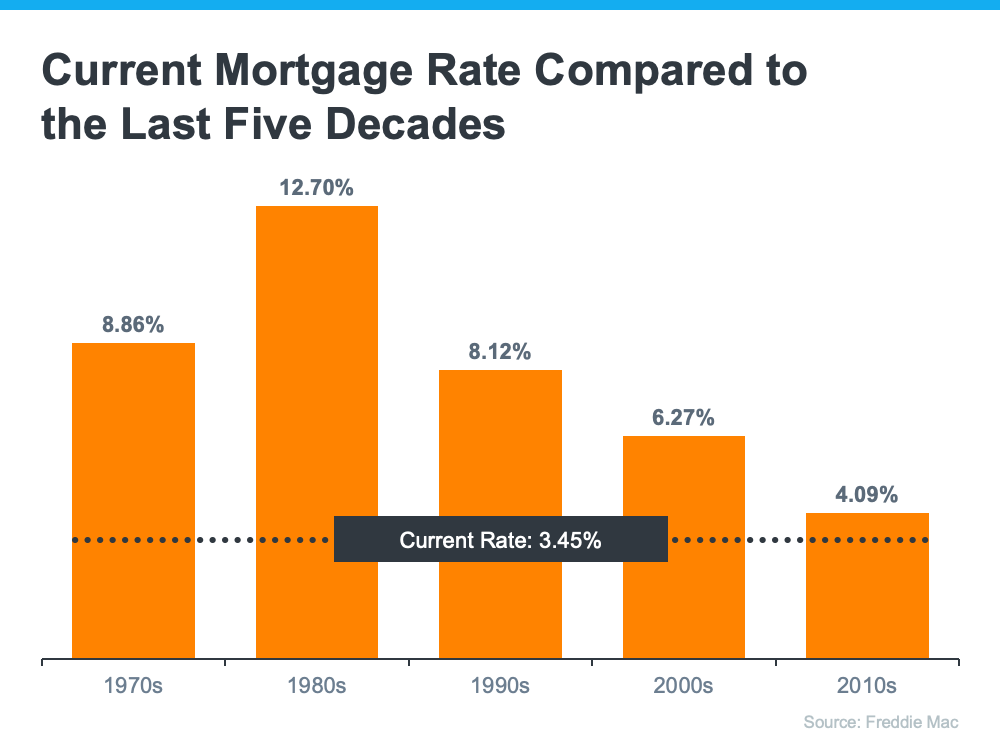

The good news is, even though rates are climbing, they’re still worth taking advantage of. Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades (see chart below):

That means you still have a great opportunity to buy now with a rate that’s better than what your loved ones may have paid in decades past. If you buy a home while rates are in the mid-3s, your monthly mortgage payment will be locked in at that rate for the life of your loan. As you can see from the chart above, a lot can change in that time frame. Buying now is a great way to protect yourself from rising costs and future rate increases while also securing your payment amount for the long term.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“Mortgage rates surged in the second week of the new year. The 30-year fixed mortgage rate rose to 3.45% from 3.22% the previous week. If inflation continues to grow at the current pace, rates will move up even faster in the following months.”

Bottom Line

Mortgage rates are increasing, and they’re forecast to be even higher by the end of 2022. If you’re planning to buy this year, acting soon may be your most affordable option. Let’s connect to start the homebuying process today.

San Antonio Homes Sold in Almost Half the Time in September

Buyer demand for homes remained strong in San Antonio in September and the month closed with 3,651 homes sold, which was almost the same as the number of homes sold in September 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report.

Single family homes stayed on the market for an average of only 27 days in September, compared to an average of 53 days in September 2020, so homes sold 49% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are moving quickly in this market.

The average price of a home sold in the San Antonio area in September was $351,379, which is a 15% increase over September 2020. The median price homes sold for in September was $296,900, a 15% increase over the September 2020 median price.

Average sold price per square foot was $165 per square foot, which is 18% higher than in September 2020.

The number of condominium and townhome sales increased by 42% in September compared to September 2020, with 102 units sold and the average price of condos and townhomes increased by 11% over September 2020 to $213,851. Condominiums and townhomes stayed on the market for only 44 days in September, compared to 61 days one year ago, which is 28% percent faster than last September

September ended with 6,112 listings on the market including 3,808 new listings. The month ended with three 3,008 sales pending.

We are still in a strong seller’s market in San Antonio with only 1.8 months of inventory available in September.

While this lack of homes for sale is creating a challenge for many buyers, there is a huge opportunity for sellers right now. According to CoreLogic, the average home has appreciated by more than $50,000 over the past year. This is a great time for sellers to take advantage of low interest rates and make a move by using their equity to move up, downsize or find a home that better suits their needs.

If you have been thinking of selling your home but are wondering how to buy your next home while selling your current home or have renovations or improvements that need to be done prior to selling your home, I have several programs that you may be interested in. These options range from cash offers if you want to sell your home as-is, access to financing for renovations if you want to fix up and sell your home for top dollar and a new program available in the San Antonio area which allows you to buy and move into to your next home, before selling your current home!

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year with rates below three percent 3% for a 30-year mortgage loan. However, Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will be gradually increasing over the next few months and into 2022.

While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. In September there were 324 lots sold which was 22% less lots and acreage properties sold compared to the 417 that sold in September 2020. The average price of lots increased to $140,408 a 28% increase compared to one year ago. Lots and acreage properties spent an average of only 109 days on the market in September 2021, which is 38% faster than the average of 177 days in 2020.

Rural Farms and Ranches continued to see increased sales activity with 42 farms and ranches sold in September which is 18% less than the 51 that sold in September 2020. The average price of rural farm and ranch properties that sold was $1,204,105 which was 37% higher than the average price of farm and ranch properties that sold in September 2020.

If you are looking to sell a home or buy a home in the San Antonio area, or have questions about the current real estate market please contact Trudy Edwards, REALTOR with Trues SA Real Estate Team – KELLER WILLIAMS Heritage.

San Antonio Area Home Prices Saw Double Digit Increases in June

San Antonio home sales activity was strong in June as buyers competed for a limited supply of homes on the market. The area saw double digit increases in average and median sales prices

The month of June ended with 4,024 single family homes sold in the San Antonio area, a twenty 5% increase in the number of homes sold over June 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report.

The average price of a home sold in the San Antonio area increased to $345,114 a 19% increase over June 2020. The median price homes sold for increased to $292,600, a 17% increase over the June 2020 median price.

Average sold price per square foot was $159 per square foot, which is 20% higher than in June 2020.

Condominium and townhome sales were robust in June, with 114 units sold, 61% higher than the 71 units sold in June 2020. The average price of condos and townhomes increased by 25% increase over June 2020 to $222,853.

The month of June ended with 5,096 listings on the market including 4,476 new listings. The month ended with 3,400 sales pending.

In June single family homes stayed on the market for an average of only 26 days compared to an average of 60 days in June 2020, so homes sold 57% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are moving quickly in this market.

We are in a strong seller’s market in San Antonio right now with only 1.5 months of inventory available in June which is a slight increase from the 1.3 months that was available in May.

With this severe shortage of inventory, strong home prices and possibly the best Sellers’ Market we have seen for over a decade, this could be the best time for home owners to list their homes for sale.

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year with rates below three percent 3% for a 30-year mortgage loan. Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will remain at or close to three percent, throughout 2021.

While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. June 2021 saw a 29% increase in the number of lots and acreage properties sold compared to June 2020, with 458 lots sold. The average price of lots increased by 62% compared to one year ago to $147,907. Lots and acreage spent an average of 106 days on the market in June 2020, which is 47% less than the average of 200 days in June 2020.

Rural Farms and Ranches continued to see increased sales activity with 60 farms and ranches sold in June which is 46% more sales compared to the 41 that sold in June twenty twenty 2020. The average price of rural farm and ranch properties that sold was $873,222 which was 25% higher than the average price of farm and ranch properties that sold in June 2020.

If you are looking to sell a home or buy a home in the San Antonio area, or have questions about the current real estate market please contact Trudy Edwards, REALTOR with Trues SA Real Estate Team – KELLER WILLIAMS Heritage.

*Increases represent year-over-year comparison as reported by the San Antonio Board of REALTORs.

San Antonio Home Sales Set a Strong Pace in March

San Antonio area real estate market update with the March 2021 real estate sales data and trends

Market Conditions – San Antonio home sales activity was strong in March with 3,516 single family homes sold, a 16% increase in the number of homes sold over March 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report.

Average and Median Home Prices -The average price of a home sold in the San Antonio area increased to $316,971, a 15% increase over March 2020. The median price homes sold increased to $268,500, 12% higher than one year ago.

Average sold price per square foot was $148, which is 14% higher compared to March 2020.

Condominium and Townhomes – Condominium and townhome sales were strong in March, with 92 units sold, 53% higher than the 60 units sold in March 2020. The average price of condos and townhomes was $232,936 a 36% increase over March 2020

Inventory and Days on Market – The month of March ended with 4,340 listings on the market including 3,739 new listings. The month ended with 3,622 sales pending.

The average number of days that single family homes stayed on the market in March was only 45 days compared to an average of 69 days in March 2020, so homes sold 35% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are moving quickly in this market.

Dr. Lynn Fisher Deputy Director of FHFA’s Division of Research and Statistics noted that “House prices nationwide recorded the largest annual and quarterly increase in the history of the FHFA HPI. Low mortgage rates, pent up demand from homebuyers, and a limited housing supply propelled every region of the country to experience faster growth in 2020 compared to a year ago despite the pandemic.”

We are in a strong seller’s market in San Antonio right now with only 1.3 months of inventory available in March, down slightly from the 1.4 months that was available in February, 2021.

Homes that are attractively presented and priced right are moving quickly in this market.

“It’s not just a sellers’ market, it’s a super sellers’ market… This is an incredibly competitive homebuying environment.”

Odeta Kushi Deputy Chief Economist at First American

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year. Although interest rates have increased slightly from their record low at the start of the year, rates are still close to three percent 3% for a 30-year mortgage loan. Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will remain at or close to three percent, throughout 2021.

Residential Lots & Acreage – While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. March 2021 saw a twenty one percent 119% increase in the number of lots and acreage properties sold compared to March 2020, with 532 lots sold. The average price of lots increased by thirty four percent (34%) compared to one year ago.

Rural Farms and Ranches Rural Farms and Ranches continued to see increased sales activity with 83 farms and ranches sold in March which is 168% more sales compared to the 31 that sold in March twenty twenty 2020. The average price of rural farm and ranch properties that sold was$810,444 which was ten percent 10% lower than the average price of farm and ranch properties that sold in March 2020.

If you are thinking of buying or selling a home in the San Antonio metropolitan area, and want to learn more about to safely buy or sell home at this time and work with a trusted San Antonio REALTOR® throughout the process, contact Trudy Edwards of KELLER WILLIAMS Realty Heritage, at (210) 595-9801, or by email at TrueSARealEstate@gmail.com.

| SA Home Sales Recap | Mar-21 | Mar-20 | Mar-19 |

| Month Sales | 3,516 homes (16% increase)* | 3,029 | 2,907 |

| Average Price | $316,971 (15% increase)* | $275,695 | $261,616 |

| Median Price | $268,500 (12% increase)* | $239,500.00 | $227,200 |

| Avg. Days on Market | 45 days | 69 days | 68 days |

*Percentage increases are based on a year-over-year comparison. Data sources San Antonio Board of REALTORS.

San Antonio Area Home Sales Continued Double Digit Increases November

The San Antonio area Real Estate market continued at a strong pace in November with 3,125 single family homes sold, which is a 27% increase in the amount of homes sold compared to November 2019 as reported by the San Antonio Board of Realtors Multiple Listing Service Report.

San Antonio Home values continued their upward trend in November with the average price of a home sold in the San Antonio area increasing to $311,604, a 19% increase over November 2019. The median price of a sold home increased to two hundred, sixty thousand, nine hundred dollars $260,900, which is 13% higher than one year ago.

Average sold price per square foot increased to $143 dollars, a 13% increase compared to November 2019.

Condominium and townhome sales were also up dramatically in November, with a 48% increase in the number of units sold and a 30% increase in average sales price compared to November 2019. Condos and townhomes sold for an average of $260,015 in November compared to $206,608 in November 2019.

At the end of November there were 6,197 listings on the market including 3,092 new listings. The month ended with 2,757 sales pending.

The average days on market in November was only 49 days, the same as October 2020 and 11 days less than in November 2019. Homes that are ready to move in to, attractively presented and priced right are moving quickly in this market.

We are in a strong seller’s market in San Antonio right now with only 2 months of inventory available in November, down slightly from 2.17 months in October.

With historically low interest rates, strong buyer demand and low inventory, this is a great time for sellers to be on the market. Lawrence Yun, Chief Economists at the National Association of REALTORS remarked that “This winter may be one of the best winters for sales activity” and that “On a winter to winter comparison this could e one of the best breakout years”…”based on the fact that pending contracts are at such a higher level”

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year with rates below three percent 3% for a 30-year mortgage loan. Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will remain at or close to three percent, throughout twenty twenty one.

While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. November saw a 57% increase in the number of lots sold compared to November 2019, with 384 lots sold. The average price of lots increased by seventeen percent 17% compared to one year ago.

Rural Farms and Ranches also saw huge increases in sales volume with 48 farms and ranches sold in November which is 14% more sales compared to the 42 sold in November 2019. The average price of rural farm and ranch properties that sold was $708,493 which was just -1% lower than in November 2019.

COVID-19 has impacted the real estate industry and influenced the way we conduct business. At True SA Real Estate Team, Keller Williams Heritage we are committed to helping our clients and customers stay safe throughout the home buying and selling process and are following the CDC guidelines and State and local mandates. We are also leveraging technology such as virtual tours, 3D tours, video tours and virtual open houses to allow home buyers to see homes for sale from the comfort of their homes.

If you are thinking of buying or selling a home in the San Antonio metropolitan area, and want to learn more about to safely buy or sell home at this time and work with a trusted San Antonio REALTOR® throughout the process, contact Trudy Edwards of KELLER WILLIAMS Realty Heritage, at (210) 595-9801, or by email at TrueSARealEstate@gmail.com.