Blog Archives

How Inflation Affects Mortgage Rates

When you read about the housing market in the news, you might see something about a recent decision made by the Federal Reserve (the Fed). But how does this decision affect you and your plans to buy a home? Here’s what you need to know.

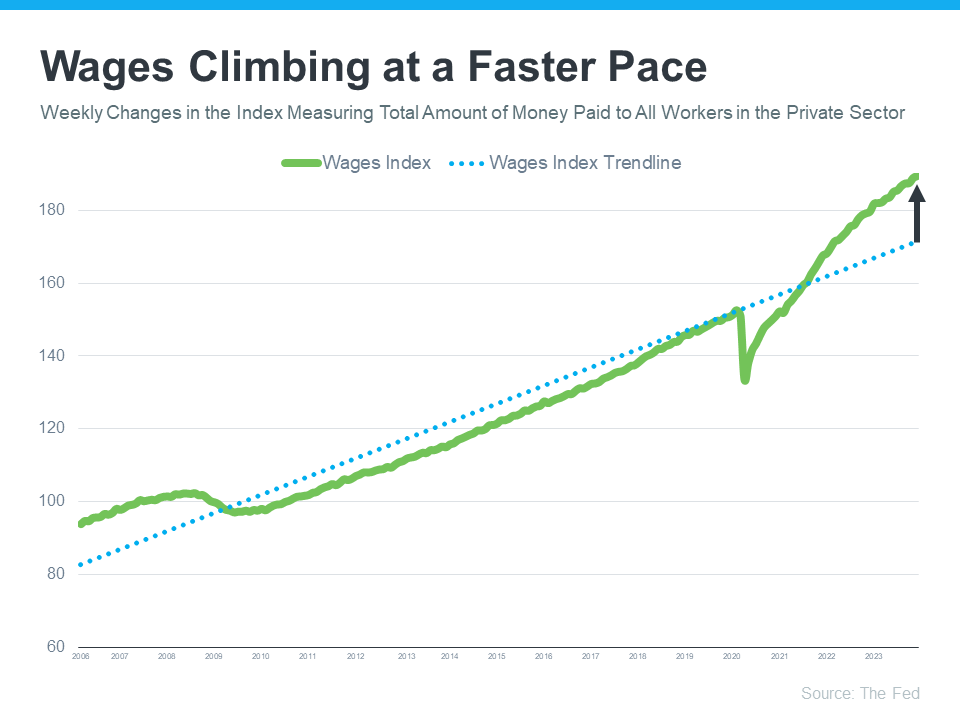

The Fed is trying hard to reduce inflation. And even though there’s been 12 straight months where inflation has cooled (see graph below), the most recent data shows it’s still higher than the Fed’s target of 2%:

While you may have been hoping the Fed would stop their hikes since they’re making progress on their goal of bringing down inflation, they don’t want to stop too soon, and risk inflation climbing back up as a result. Because of this, the Fed decided to increase the Federal Funds Rate again last week. As Jerome Powell, Chairman of the Fed, says:

“We remain committed to bringing inflation back to our 2 percent goal and to keeping longer-term inflation expectations well anchored.”

Greg McBride, Senior VP, and Chief Financial Analyst at Bankrate, explains how high inflation and a strong economy play into the Fed’s recent decision:

“Inflation remains stubbornly high. The economy has been remarkably resilient, the labor market is still robust, but that may be contributing to the stubbornly high inflation. So, Fed has to pump the brakes a bit more.”

Even though a Federal Fund Rate hike by the Fed doesn’t directly dictate what happens with mortgage rates, it does have an impact. As a recent article from Fortune says:

“The federal funds rate is an interest rate that banks charge other banks when they lend one another money . . . When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.”

How All of This Affects You

In the simplest sense, when inflation is high, mortgage rates are also high. But, if the Fed succeeds in bringing down inflation, it could ultimately lead to lower mortgage rates, making it more affordable for you to buy a home.

This graph helps illustrate that point by showing that when inflation decreases, mortgage rates typically go down, too (see graph below):

As the data above shows, inflation (shown in the blue trend line) is slowly coming down and, based on historical trends, mortgage rates (shown in the green trend line) are likely to follow. McBride says this about the future of mortgage rates:

“With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably.”

Bottom Line

What happens to mortgage rates depends on inflation. If inflation cools down, mortgage rates should go down too. If you’re thinking of making a move in the San Antonio area, let’s talk so you can get expert advice on housing market changes and what they mean for you.

With Mortgage Rates Climbing, Now’s the Time To Act

Last week, the average 30-year fixed mortgage rate from Freddie Mac jumped from 3.22% to 3.45%. That’s the highest point it’s been in almost two years. If you’re thinking about buying a home, this news may have come as a bit of a shock. But the truth is, it wasn’t entirely unexpected

Experts have been calling for rates to rise in their 2022 projections, and the forecast is now becoming a reality. Here’s a look at the projections from Freddie Mac for this year:

- Q1 2022: 3.4%

- Q2 2022: 3.5%

- Q3 2022: 3.6%

- Q4 2022: 3.7%

As the numbers show, this jump in rates is in line with the expectations from Freddie Mac. And what they also indicate is that mortgage rates are projected to continue climbing throughout the year. But should you be worried about rising mortgage rates? What does that really mean for you?

As rates increase even modestly, they impact your monthly mortgage payment and overall affordability. If you’re looking to buy a home, rising mortgage rates should be an incentive to act sooner rather than later.

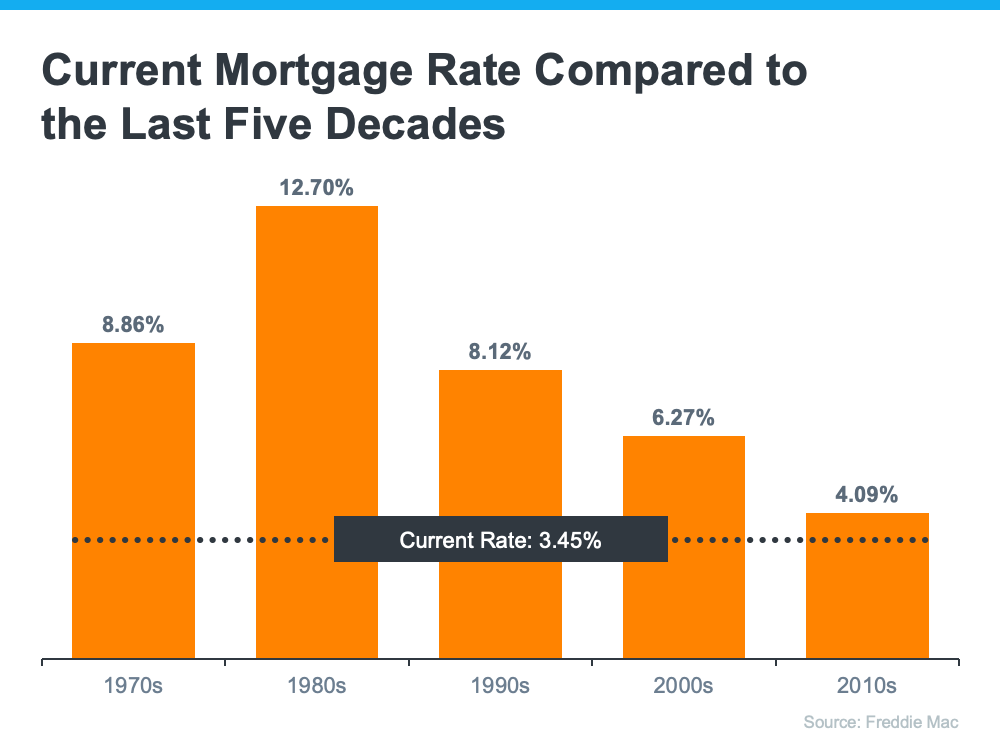

The good news is, even though rates are climbing, they’re still worth taking advantage of. Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades (see chart below):

That means you still have a great opportunity to buy now with a rate that’s better than what your loved ones may have paid in decades past. If you buy a home while rates are in the mid-3s, your monthly mortgage payment will be locked in at that rate for the life of your loan. As you can see from the chart above, a lot can change in that time frame. Buying now is a great way to protect yourself from rising costs and future rate increases while also securing your payment amount for the long term.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“Mortgage rates surged in the second week of the new year. The 30-year fixed mortgage rate rose to 3.45% from 3.22% the previous week. If inflation continues to grow at the current pace, rates will move up even faster in the following months.”

Bottom Line

Mortgage rates are increasing, and they’re forecast to be even higher by the end of 2022. If you’re planning to buy this year, acting soon may be your most affordable option. Let’s connect to start the homebuying process today.

Expert Insights on the 2022 Housing Market

As we move into 2022, both home buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we turn to the experts. Here’s a look at what they say we can expect in 2022.

Odeta Kushi, Deputy Chief Economist, First American:

“Consensus forecasts put rates at about 3.7% by the end of next year. So, that’s still historically low, but certainly higher than they are today.”

Danielle Hale, Chief Economist, realtor.com:

“Affordability will increasingly be a challenge as interest rates and prices rise, but remote work may expand search areas and enable younger buyers to find their first homes sooner than they might have otherwise. And with more than 45 million millennials within the prime first-time buying ages of 26-35 heading into 2022, we expect the market to remain competitive.”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“With more housing inventory to hit the market, the intense multiple offers will start to ease. Home prices will continue to rise but at a slower pace.”

George Ratiu, Manager of Economic Research, realtor.com:

“We also expect a growing number of homeowners to bring properties to market, taking some pressure off high prices and offering buyers more options.”

Mark Fleming, Chief Economist, First American:

“Strong demographic demand will continue to act as the wind in the housing market’s sails.”

What Does This Mean for Buyers?

Hope is on the horizon for 2022. You should see your options grow as more homes are listed and some of the peak intensity of buyer competition starts to ease. Just remember, rising rates and prices are a great motivator for you to find the home of your dreams sooner rather than later so you can buy while today’s affordability is still in your favor.

What Does This Mean for Sellers?

Make no mistake – this sellers’ market will remain in 2022 as home prices are projected to continue climbing, just at a more moderate pace. Selling your house while buyer demand is so high will truly put you in the driver’s seat. But don’t wait too long. With more listings projected to become available, your ideal window of opportunity to stand out from the crowd won’t last forever. Work with an agent who knows your local market and current inventory conditions to ensure you have the support you need to make an educated and informed decision about selling in the coming year.

Bottom Line

If you’re thinking of buying or selling, 2022 may be your year. Let’s connect to discuss your goals and the unique opportunities you have in today’s housing market.

San Antonio Area Home and Land Prices Rose Amidst Low Inventory in November

The number of single family homes sold in the San Antonio area dipped slightly in November to 3,027 homes sold, which was 4% less than the number of homes sold in November 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report.

Despite the decrease in the number of homes sold in November, all other signs indicate that home buyer demand is still very strong.

The latest Showing Index from ShowingTime, which tracks the average number of monthly showings on available homes, indicates buyer activity was slightly lower than at the same time last year but much higher than any of the three previous years

In November single family homes stayed on the market for an average of only 32 days compared to an average of 49 days in November 2020, so homes sold 35% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are selling quickly in this market.

Home prices also continued their strong upward trend. The average price of a home sold in the San Antonio area in November was $359,545, a 17% increase over November 2020. The median price homes sold for in November was $307,200, a 19% increase over the November 2020 median price.

Average sold price per square foot was $170 per square foot, which is 19% higher than in November 2020. Another indicator of the strength of home buyer demand is that of the homes sold, 99.5 percent sold for the listed price, compared to ninety eight point two percent 98.2% of homes in November 2020.

The number of Condominium and townhome sales increased by 22% in November with 88 units sold. However, the average sold price of condos and townhomes at $231,236 was 12% lower. Condominiums and townhomes stayed on the market for only 42 days in November, compared to 49 days one year ago, so condos and townhomes sold 14% faster than last November.

The month of November ended with 5,437 listings on the market including three thousand, 3,323 new listings. The month ended with 2,955 sales pending.

The San Antonio area had only 1.6 months of housing inventory available in November, which is down slightly from the 1.7 months that was available in October. A supply of six months of inventory is considered to be a balanced market so we are still in a very strong Sellers’ market.

With such low housing inventory, strong home prices and possibly the best Sellers’ Market we have seen for over a decade, this could be the best time for home owners to list their homes for sale.

While this lack of homes for sale is creating a challenge for many buyers, there is a huge opportunity for sellers right now. According to CoreLogic, the average home has appreciated by more than $50,000 over the past year. This is a great time for sellers to take advantage of low interest rates and make a move by using their equity to move up, downsize or find a home that better suits their needs.

If you have been thinking of selling your home but are wondering how to buy your next home while selling your current home or have renovations or improvements that need to be done prior to selling your home, I have several programs that you may be interested in. These options range from cash offers if you want to sell your home as-is, access to financing for renovations if you want to fix up and sell your home for top dollar and a new program available in the San Antonio area which allows you to buy and move into to your next home, before selling your current home!

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year with rates below three percent 3% for a 30-year mortgage loan. However, Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will be gradually increasing over the next few months and into 2022.

Some people may be wondering if rising mortgage rates will result in lower home prices. Historic data does not support that. Mark Fleming, Chief Economist at First American, recently stated that “House price appreciation is resistant to rising mortgage rates primarily because most home sellers would rather withdraw from the market that sell at lower prices”

The number of residential lots and acreage properties sold in November saw a 14% percent decrease in the number of units sold in November, with 332 lots sold compared to the 388 that sold in November 2020. However, the average price of lots increased to $140,546 a thirty six percent 36% increase compared to one year ago. Lots and acreage properties spent an average of only one hundred eight 108 days on the market in November, which is 32% less time on the market than in November 2020.

The number of Rural Farms and Ranches sold in November was exactly the same as November twenty twenty, with 48 farms and ranches sold in November. The average price of rural farm and ranch properties that sold was $1,241,605 which was 71% higher than the average price of farm and ranch properties that sold in November 2020.

If you are thinking of buying or selling a home in the San Antonio metropolitan area, and want to work with a trusted San Antonio REALTOR® throughout the process, contact Trudy Edwards of KELLER WILLIAMS Realty Heritage, at (210) 595-9801, or by email at TrueSARealEstate@gmail.com.

Sellers Have Incredible Leverage in Today’s Market

With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year.

Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), puts it best, saying:

“Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year.”

But the sense of urgency they feel is complicated by the lack of homes for sale in today’s market. According to the latest Existing Home Sales Report from NAR:

“From one year ago, the inventory of unsold homes decreased 13%. . . .”

What Does This Mean for Sellers Today?

With buyers eager to purchase but so few homes available, sellers who list their houses this fall have a tremendous advantage – also known as leverage – when negotiating with buyers. That’s because, in today’s market, buyers want three things:

- To be the winning bid on their dream home.

- To buy before rates rise

- To buy before prices go even higher.

Your Leverage Can Help You Negotiate Your Best Terms

These three buyer needs give homeowners a leg up when selling their house. You might already realize this leverage enables you to sell at a good price, but it also means you can negotiate the best terms to suit your needs.

And since buyer demand is still high, there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, look closely at the terms of each offer to find out which one has the best perks for you.

If you have questions about what’s best for your situation, your trusted real estate advisor can help. They have the expertise and are skilled negotiators in all stages of the sales process.

Bottom Line

Today’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling a home. Let’s connect today to discuss how much leverage you have as a seller in today’s San Antonio area market.

San Antonio Area Saw Double Digit Home Price Increase in August

San Antonio area real estate market update with the August real estate sales data and trends

The San Antonio area continued to see strong home buyer demand in August and the month ended with 3,726 single family homes sold in August, which was 2% higher than the number of homes sold in August 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report.

We are still in a strong seller’s market in San Antonio with only 1.8 months of inventory available in August which was a slight increase from the 1.7 months that was available in July.

In August single family homes stayed on the market for an average of only 24 days compared to an average of 55 days in August 2020, so homes sold 21% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are moving quickly in this market. The average price of a home sold in the San Antonio area in August was $353,662, a 19% increase over August 2020. The median price homes sold for in August was $298,200, a 16% increase over the August 2020 median price.

Average sold price per square foot was $164 per square foot, which is 21% higher than in August 2020.

Condominium and townhome sales decreased by 1% in August compared to August 2020, with 94 units sold. The average price of condos and townhomes increased by 27% over August 2020 to $218,972. Condominiums and townhomes stayed on the market for only 38 days in August, compared to 68 days one year ago.

The month of August ended with 6,200 listings on the market including 4,663 new listings. The month ended with 3,434 sales pending.

National data also show that in July homes received an average of 4.5 offers. Part of the reason for this is the lack of inventory. Where sellers would have listed their homes for sale last spring and this spring and summer, concerns about COVID-19 and associated concerns may still be causing some potential sellers to hold off listing their homes for sale. We are gradually seeing more inventory coming to the market and expect this fall to be a busy season.

With this severe shortage of inventory, strong home prices and possibly the best Sellers’ Market we have seen for over a decade, this could be the best time for home owners to list their homes for sale.

Some potential home sellers may be wondering where they will move to next and wondering how to buy their next home while selling their current home. If you have been thinking of selling your San Antonio home but are wondering how to sell and buy your next home in this market, I have several solutions that you may be interested in, including Knock Home Swap, a new program in the San Antonio area which allows you to move up to your next home, before selling your current home!

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year with rates below three percent 3% for a 30-year mortgage loan. Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will remain at or close to three percent, throughout 2021.

While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. August 2021 saw a 5% decrease in the number of lots and acreage properties sold compared to August 2020, with 399 lots sold. The average price of lots increased by 37% compared to one year ago to $138,877. Lots and acreage spent an average of only 88 days on the market in August twenty twenty one 2021, which is fifty eight percent (58%) less than the average of two hundred ten(210) days in August twenty twenty (2020).

Rural Farms and Ranches continued to see increased sales activity with 51 farms and ranches sold in August which is 7% less sales compared to the 55 that sold in August 2020. The average price of rural farm and ranch properties that sold was $1,466,243 which was 119% higher than the average price of farm and ranch properties that sold in August 2020.

If you are looking to sell a home or buy a home in the San Antonio area, or have questions about the current real estate market please contact Trudy Edwards, REALTOR with Trues SA Real Estate Team – KELLER WILLIAMS Heritage.

*Increases represent year-over-year comparison as reported by the San Antonio Board of REALTORs.