Monthly Archives: September 2021

San Antonio Area Saw Double Digit Home Price Increase in August

San Antonio area real estate market update with the August real estate sales data and trends

The San Antonio area continued to see strong home buyer demand in August and the month ended with 3,726 single family homes sold in August, which was 2% higher than the number of homes sold in August 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report.

We are still in a strong seller’s market in San Antonio with only 1.8 months of inventory available in August which was a slight increase from the 1.7 months that was available in July.

In August single family homes stayed on the market for an average of only 24 days compared to an average of 55 days in August 2020, so homes sold 21% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are moving quickly in this market. The average price of a home sold in the San Antonio area in August was $353,662, a 19% increase over August 2020. The median price homes sold for in August was $298,200, a 16% increase over the August 2020 median price.

Average sold price per square foot was $164 per square foot, which is 21% higher than in August 2020.

Condominium and townhome sales decreased by 1% in August compared to August 2020, with 94 units sold. The average price of condos and townhomes increased by 27% over August 2020 to $218,972. Condominiums and townhomes stayed on the market for only 38 days in August, compared to 68 days one year ago.

The month of August ended with 6,200 listings on the market including 4,663 new listings. The month ended with 3,434 sales pending.

National data also show that in July homes received an average of 4.5 offers. Part of the reason for this is the lack of inventory. Where sellers would have listed their homes for sale last spring and this spring and summer, concerns about COVID-19 and associated concerns may still be causing some potential sellers to hold off listing their homes for sale. We are gradually seeing more inventory coming to the market and expect this fall to be a busy season.

With this severe shortage of inventory, strong home prices and possibly the best Sellers’ Market we have seen for over a decade, this could be the best time for home owners to list their homes for sale.

Some potential home sellers may be wondering where they will move to next and wondering how to buy their next home while selling their current home. If you have been thinking of selling your San Antonio home but are wondering how to sell and buy your next home in this market, I have several solutions that you may be interested in, including Knock Home Swap, a new program in the San Antonio area which allows you to move up to your next home, before selling your current home!

Part of the reason for continued strong home buyer demand is that we have seen record low interest rates this year with rates below three percent 3% for a 30-year mortgage loan. Freddie Mac, The Federal Home Loan Mortgage Corporation, projects that interest rates on a 30-year mortgage will remain at or close to three percent, throughout 2021.

While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. August 2021 saw a 5% decrease in the number of lots and acreage properties sold compared to August 2020, with 399 lots sold. The average price of lots increased by 37% compared to one year ago to $138,877. Lots and acreage spent an average of only 88 days on the market in August twenty twenty one 2021, which is fifty eight percent (58%) less than the average of two hundred ten(210) days in August twenty twenty (2020).

Rural Farms and Ranches continued to see increased sales activity with 51 farms and ranches sold in August which is 7% less sales compared to the 55 that sold in August 2020. The average price of rural farm and ranch properties that sold was $1,466,243 which was 119% higher than the average price of farm and ranch properties that sold in August 2020.

If you are looking to sell a home or buy a home in the San Antonio area, or have questions about the current real estate market please contact Trudy Edwards, REALTOR with Trues SA Real Estate Team – KELLER WILLIAMS Heritage.

*Increases represent year-over-year comparison as reported by the San Antonio Board of REALTORs.

Is the Number of Homes for Sale Finally Growing?

An important metric in today’s residential real estate market is the number of homes available for sale.

The shortage of available housing inventory is the major reason for the double-digit price appreciation we’ve seen in each of the last two years. It’s the reason many would-be purchasers are frustrated with the bidding wars over the homes that are available. However, signs of relief are finally appearing.

According to data from realtor.com, active listings have increased over the last four months. They define active listings as:

“The active listing count tracks the number of for sale properties on the market, excluding pending listings where a pending status is available. This is a snapshot measure of how many active listings can be expected on any given day of the specified month.”

What normally happens throughout the year?

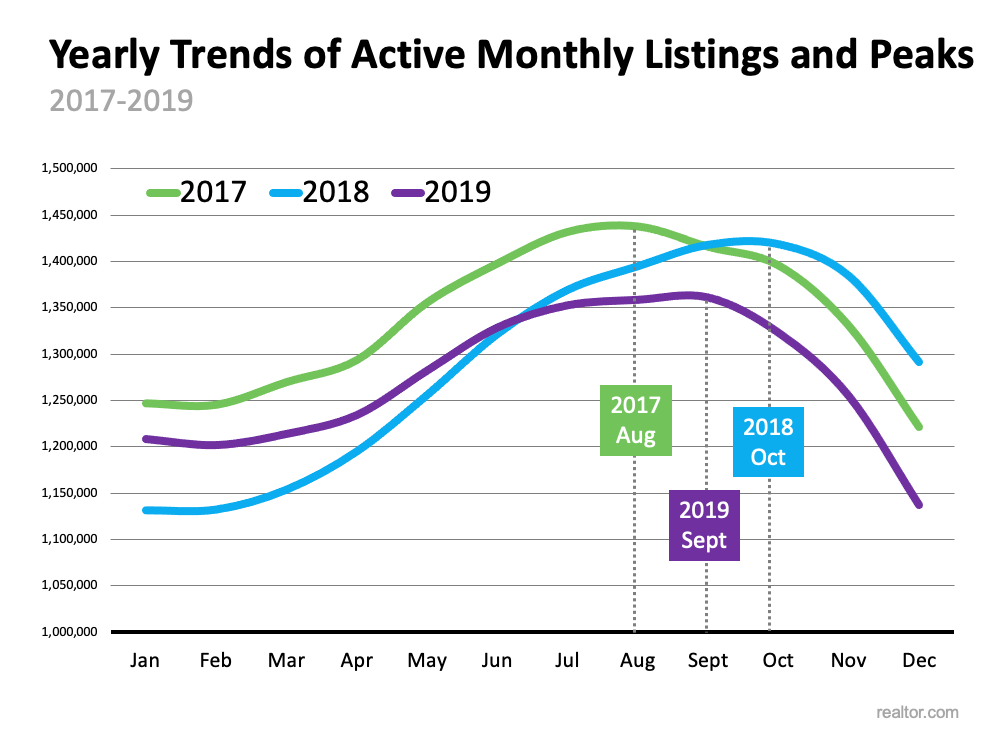

Historically, housing inventory increases throughout the summer months, starts to tail off in the fall, and then drops significantly over the winter. The graph below shows this trend along with the month active listings peaked in 2017, 2018, and 2019.

What happened last year?

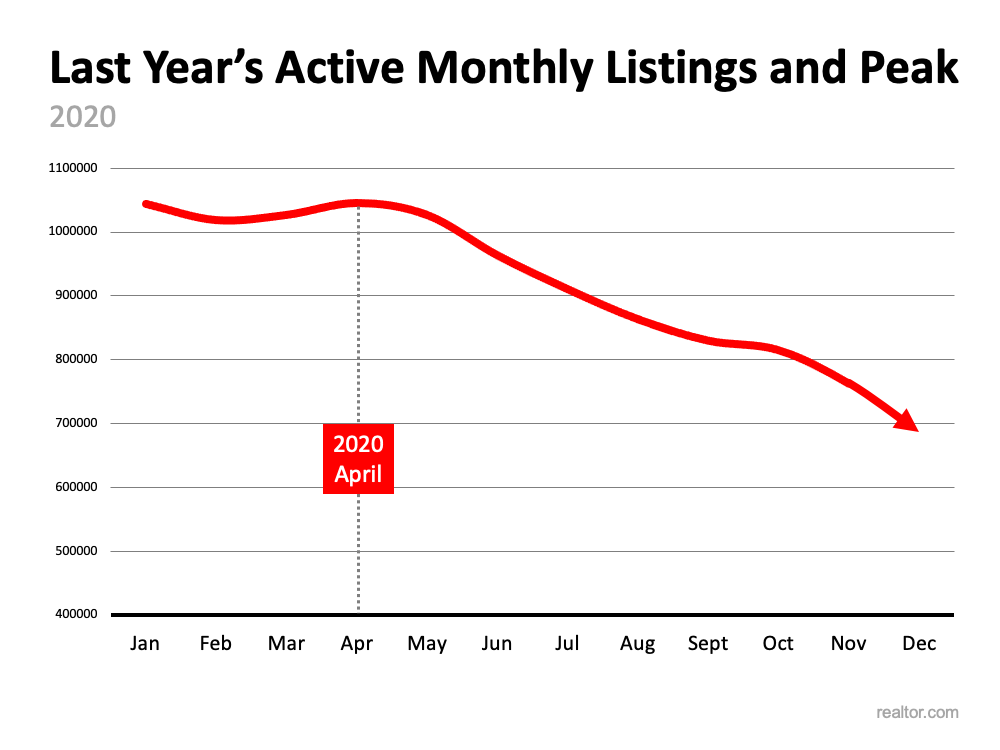

Last year, the trend was different. Historical seasonality wasn’t repeated in 2020 since many homeowners held off on putting their houses up for sale because of the pandemic (see graph below). In 2020, active listings peaked in April, and then fell off dramatically for the remainder of the year.

What’s happening this year?

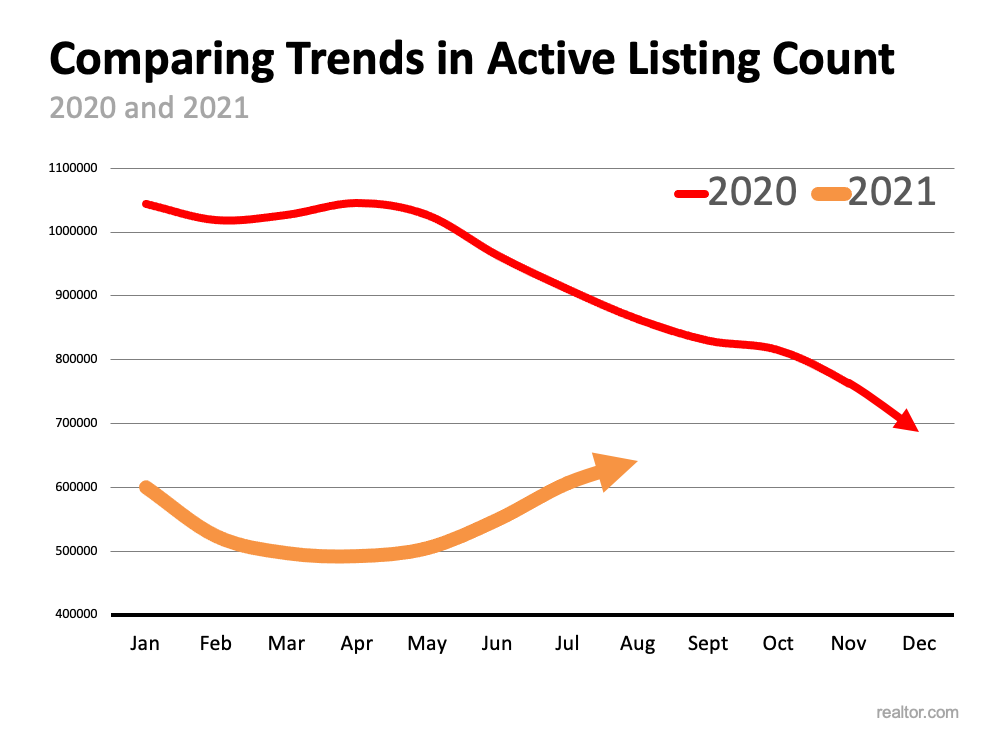

Due to the decline of active listings in 2020, 2021 began with record-low housing inventory counts. However, we’ve been building inventory over the last several months as more listings come to the market (see graph below):There are three main reasons we may see listings continue to increase throughout this fall and into the winter.

- Pent-up selling demand – Homeowners may be more comfortable putting their homes on the market as more and more Americans get vaccinated.

- New construction is starting to take off – Though new construction is not included in the realtor.com numbers, as more new homes are built, there will be more options for current homeowners to consider when they sell. The lack of options has slowed many potential sellers in the past.

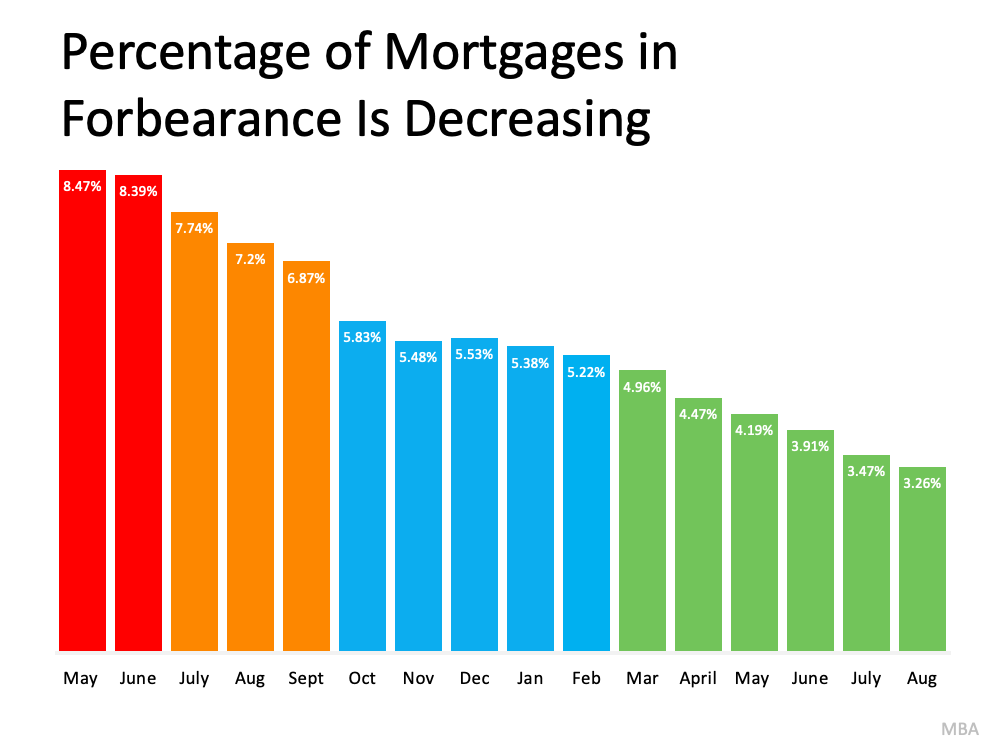

- The end of forbearance will create some new listings – Most experts believe the end of the forbearance program will not lead to a wave of foreclosures for several reasons. The main reason is the level of equity homeowners currently have in their homes. Many homeowners will be able to sell their homes instead of going to foreclosure, which will lead to some additional listings on the market.

Bottom Line

If you’re in the market to buy a home, stick with it. There are new listings becoming available every day. If you’re thinking of selling your house, you may want to list your home before this additional competition comes to market.

Understand Your Options To Avoid Foreclosure

Even though experts agree there’s no chance of a large-scale foreclosure crisis, there are a number of homeowners who may be coming face-to-face with foreclosure as a possibility. And while the overall percentage of homeowners at risk is decreasing with time (see graph below), that’s little comfort to those individuals who are facing challenges today.If you haven’t taken advantage of the forbearance period, it may be time to research and understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this:

“Foreclosure is the legal process by which a lender attempts to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property. Typically, default is triggered when a borrower misses a specific number of monthly payments . . .”

The good news is, there are alternatives available to help you avoid having to go through the foreclosure process, including:

- Reinstatement

- Loan modification

- Deed-in-lieu of foreclosure

- Short sale

But before you go down any of those paths, it’s worth seeing if you have enough equity in your home to sell it and protect your investment.

Understand Your Options: Sell Your House

Equity is the difference between what you owe on the home and its market value based on factors like price appreciation.

In today’s real estate market, many homeowners have far more equity in their homes than they realize. Over the last year, buyer demand has been high, but housing supply has been low. That’s led to a substantial increase in home values. When prices rise, so does the amount of equity you have in your house.

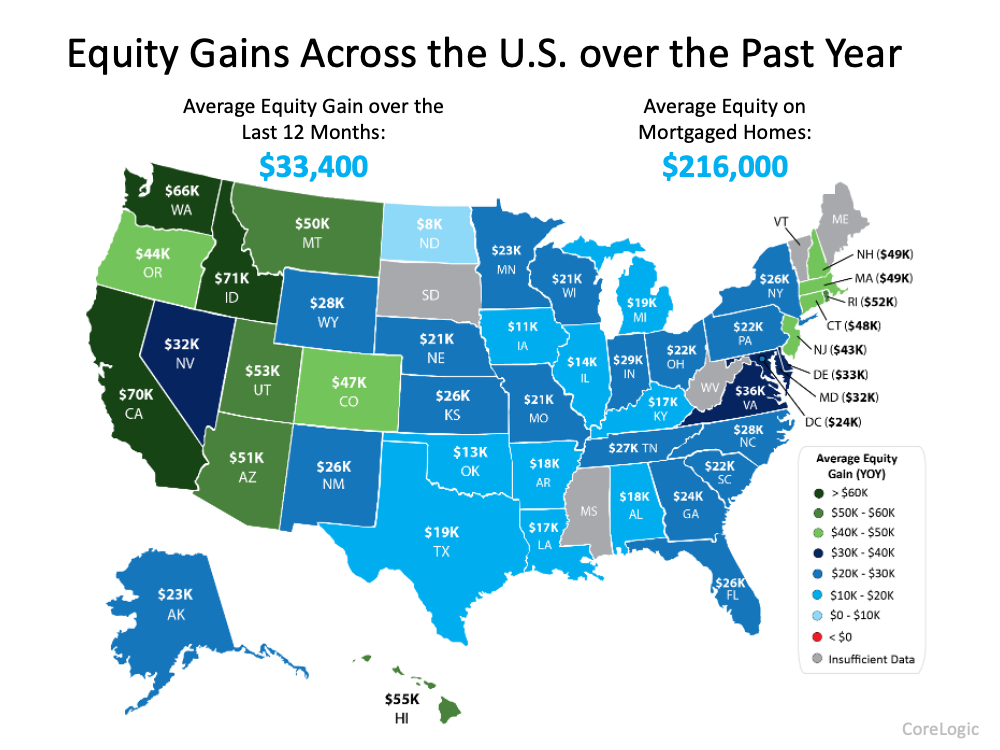

According to CoreLogic, on average, homeowners gained $33,400 in equity over the last 12 months, and the average equity on mortgaged homes is now $216,000 (see map below):So, what does that mean for you? Over the past year, chances are your home’s value and therefore your equity has risen dramatically. If you’ve been in your home for a while, the mortgage payments you’ve made over time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage.

Frank Martell, President and CEO of CoreLogic, elaborates on how equity can help:

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market.”

Don’t Go at It Alone – Lean on Experts for Advice

To find out what your house is worth in today’s market, work with a local real estate professional. We’ll be able to give you an estimate of what your house could sell for based on recent sales of similar homes in your area. Since home prices are still appreciating, you may be able to sell your house to avoid foreclosure.

If you find out that you have to pursue other options, your agent can help with that too. We’ll be able to connect you with other professionals in the industry, like housing counselors who can look into your unique situation and offer advice on next steps if selling isn’t the best alternative.

Bottom Line

If you’re a San Antonio area homeowner facing hardship, let’s connect to explore your options and see if you can sell your house to avoid foreclosure.