Blog Archives

San Antonio Home Sales Numbers Surged Again in February

Following an 11% increase in home sales in January, San Antonio home sales activity continued to strengthen in February

The number of single family homes sold in the San Antonio area in February was up 14%, compared to February 2023 with 2,697 homes sold, as reported by the San Antonio Board of REALTORS (SABOR) Multiple Listing Service Report.

Average and Median Home Prices – Despite the increase in the number of homes sold, the average price of homes sold in the San Antonio was 3% lower than February 2023. The average price of a home sold in the San Antonio area in February was $348,961. The median price homes sold for in February was $295,000, a 3% decrease compared to one year ago.

Average sold price per square foot in February was $173, which was 1%, lower than the average price per square foot in February 2023. Broken down between existing homes and new construction, existing homes sold for an average of $174 per square foot and new construction homes sold for an average of $170 per square foot in February.

Days on Market – Single family homes in the San Antonio area stayed on the market for an average of 80 days in February which was 11% eleven percent longer than in February 2023.

List Price to Sales Price Ratio – On average, homes sold for 93.1% of their original list price in February. This is up slightly from the average of 92.6% of their original list price that homes sold for in January.

Condominium and Townhomes – The number of Condominium and townhomes sold in February was 33% lower than one year ago with a total of 35 units sold. The average sold price of condos and townhomes, at $273,634 was 12% twelve percent higher than in February 2023.. Condominiums and townhomes stayed on the market for an average of 57 days in February, which was 8% eight percent less time than condos stayed on the market in February 2023.

Housing Inventory – At the end of February, there were approximately 4.3 months of inventory available for sale in the San Antonio area, so we are moving to a more balanced market. In February there were 4,011 new listings and of those, 2881 were resale homes and 1,130 were new construction. There were a total amount 11,974 homes on the market. The total number of new construction home listings at 4,120 was 6% higher than in February 2023.

New Home Sales Data – One of the most interesting trends over the past year is the increase in new home sales. The number of new construction homes sold in February was 39% higher year over year. The San Antonio new construction market has risen to meet the needs of homebuyers by increasing inventory, building more homes in the price ranges that buyers are looking for and by offering pricing and financing promotions that have helped home buyers to get into homes.

In the San Antonio area we are fortunate to have a wide range of new construction homes available and currently many home builders are offering promotional pricing, closing costs assistance and interest rate buy downs to help home buyers to get into a home. If you would like to learn more about new construction homes, you can easily search for available and to be built new construction homes and communities at https://www.showingnew.com/trudyedwards.

If you are home buyer, looking to get into a new home, but have concerns about interest rates and home affordability, here are a few things to consider. there are still lots of options available to help you get into a home such as low down payment mortgage programs, builder promotions, down payment assistance programs and creative financing strategies available to help home buyers get into a home with a more affordable monthly payment.

If you would like to learn more about down payment assistance programs and available options, contact your trusted mortgage lender or reach out to me for more information and recommendations for local lenders that can help match you to the best lending options for you.

Even if you are not quite ready to buy right now, if it’s your goal to buy a home this year, you can take steps to buying your first home and building generational wealth, by setting your goals, making a plan, taking steps to manage your finances, improving your credit and staying informed so that you’ll be ready to move forward when the opportunity arises.

If you want to make a move but have a home to sell before you can buy your next home, I have lots of options to help you sell your home with less stress and more money in your pocket!

A lot of homeowners today are sitting on tremendous home equity. But some homeowners have not been able to access that equity to make needed home repairs. Perhaps you have been putting off selling your home because you haven’t been able to make the repairs or cosmetic updates that would make your home desirable to the biggest pool of buyers. I can help you with that! Contact me today for a no obligation home seller consultation and we can review your options, including making home improvements with no upfront costs, payment at closing.

Whether you are thinking of buying a new construction home, buying your first home, or selling your your current home, it pays to work with a trusted real estate professional with local market insights. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

Browse San Antonio area new construction homes and floorplans at ShowingNew.com/TrudyEdwards

** Percentage increases are based on a year-over-year comparison of February 2024 in com

New Homes Continued to Boost San Antonio Market in December

Here is my latest San Antonio area real estate market update with the local real estate news you need to know, including the December 2023 year end real estate sales data and trends for the year ahead.

San Antonio homes sales were in December were down 3%, compared to December 2022 with 2,410 homes sold, as reported by the latest San Antonio Board of REALTORS (SABOR) Multiple Listing Service Report. However, breaking that down further, SABOR reported that while sales of resale homes were down by 10% year over year in December, sales of new construction homes were actually up by 29% when compared to December 2022.

Average and Median Home Prices – Despite the decrease in the number of homes sold in December, the average and median prices of homes sold in the San Antonio area were effectively unchanged year over year. The average price of a home sold in the San Antonio area in December was $373,797. The median price homes sold for in December was $319,113.

Average sold price per square foot in December was $177, which was unchanged from the average price per square foot in December 2022.

Days on Market – Single family homes in the San Antonio area stayed on the market for an average of 73 days in December, which was 20% twenty percent longer than in December 2022.

List Price to Sales Price Ratio – On average, homes sold for 92.7% ninety two point seven percent of their original list price in December.

Condominium and Townhomes – The number of Condominium and townhomes sold in December was unchanged from one year ago with 41 units sold. The average sold price of condos and townhomes, at $251,314 was 24% twenty four percent lower than in December 2022. Condominiums and townhomes stayed on the market for an average of 63 days in December, which was 40% longer than condos stayed on the market in December 2022.

Housing Inventory – At the end of December, there were approximately 4.3 months of inventory available for sale in the San Antonio area, so we are moving to a more balanced market. In December there were 2,771 new listings and of those, 1692 were resale homes and 1079 were new construction. The amount of new construction home listings was 55% higher than in December 2022.

New Construction Home Sales – One of the most interesting trends over the past year is the increase in new home sales. At the end of December 2023 the number of resale homes that sold in the San Antonio area for the whole year of 2023 was 23% lower than in 2022. However, at the end of 2023, the number of new construction homes sold was 39% higher year over year. The San Antonio new construction market has risen to meet the needs of homebuyers by increasing inventory, building more homes in the price ranges that buyers are looking for and by offering pricing and financing promotions that have helped home buyers to get into homes.

Interest Rates – In October 2023, the average rate for a 30-year fixed mortgage rate peaked at 7.79%. In January, that dipped to around 6.6% which was the lowest level since May of 2023. That downward trend in rates has made moving more affordable now than it was just a few months ago.

“Given this stabilization in rates, potential homebuyers with affordability concerns have jumped off the fence back into the market.”

Sam Khater, Chief Economist at Freddie Mac:

Experts are predicting that interest rates will continue gradually decreasing over the next few months. Dean Baker, Senior Economist, Center for Economic Research, recently remarked “It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

If you are a home buyer contemplating a move but have concerns about high interest rates and home affordability, here are a few things to consider.

Experts are predicting that interest rates will continue gradually decreasing over the next few months. Dean Baker, Senior Economist, Center for Economic Research, recently remarked “It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent”

If you are home buyer, looking to get into a new home, there are still lots of options to help you reach that goal, including mortgage programs, builder promotions, down payment assistance programs and creative financing strategies available to help home buyers get into a home with a more affordable monthly payment. If you would like to learn more about down payment assistance programs and available options, contact your trusted mortgage lender or reach out to me for more information and recommendations for local lenders that can help match you to the best lending options for you.

One area of opportunity for home buyers right now is with new construction home as we are fortunate to have a wide range of new construction homes available rhroughout the San Antonio area and currently many home builders are offering promotional pricing, closing cost assistance and interest rate buy downs to help home buyers to get into a home. If you would like to learn more about new construction homes, you can easily search for available and to be built new construction homes and communities at https://www.showingnew.com/trudyedwards.

Even if you are not quite ready to buy right now, if it’s your goal to buy a home this year, you can take steps to buying your first home and building generational wealth, by setting your goals, making a plan, taking steps to manage your finances, improving your credit and staying informed so that you’ll be ready to move forward when the opportunity arises.

If it’s your goal to make a move in the San Antonio area and you’d like to talk more about the steps to help you reach that goal, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

New Construction Homes in San Antonio Boosted Inventory and Sales in July

While July is often one of the busiest months for home sales, the number of single-family homes that sold in the San Antonio area in July was down 6% from the number of homes sold in July 2022 with 3,105 homes sold.

Average and Median Home Prices – However, the average price of a single family home sold in the San Antonio area in July, at $387,501 was the almost the same as the average price of a home that sold in July 2022 according to the Multiple Listing Service Report from the San Antonio Board of REALTORS. The median price homes sold for in July was $323,000 , which is a 2% decline compared to the July 2022 median price.

Average Price Per Square Foot – Average sold price per square foot in July was $182, which was 2% lower than one year ago. Breaking that down further single family existing homes, sold for an average of $182 per square foot, which was a 1% decrease compared to last year. Single family new construction homes also sold for an average of $182, which was 6% six percent lower than the average sold price per square foot that new construction homes sold for in July 2022. Single family homes in the San Antonio area stayed on the market for an average of 57 days in July which was 104% longer than in July 2022. On average, homes sold for 95.3% of their original list price in July, which was up slightly from the average of 95% of sales price in June.

Condominiums and Town Homes – The number of Condominium and townhomes sold in July was 1% higher than July 2022 with 81 units sold. The average sold price of condos and townhomes, at $254,294, was 4% higher than in July 2022. Condominiums and townhomes stayed on the market for an average of 61 days in July, which was 281% longer than the 15 days that condos stayed on the market in July 2022.

Housing Inventory – At the end of July there were approximately 3.8 months of inventory available for sale in the San Antonio area. The number of new listings was down by 17% seventeen percent in July, with only 4,258 new listings. There were 2,464 homes under contract at the end of June, which was down 18% from July 2022. At the end of July there were a total of 10,964 homes on the market in the San Antonio area, which was 25% higher than one year ago.

New Construction Homes – Over one third of the single family homes that went under contract in the San Antonio area in July were new construction homes, with 924 of the pending sales. San Antonio area builders have been taking action to help improve buyer affordability and increase sales by offering promotions such as special pricing and incentives such as promotional interest rates and rate buydowns. We are very fortunate in the San Antonio area, to have a large number of local and national home builders in our area, offering a wide range housing opportunities across a broad spectrum of areass and price ranges from multi-story town homes in the downtown area, afffordable two bedroom, no garage homes, to luxurious estate homes in master planned communities. New construction homes also have the added benefits of improved energy efficiency compared to many existing homes.

Whether you are thinking of buying a new construction home, buying your first home, or selling your your current home, it pays to work with a trusted real estate professional with local market insights. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

Browse San Antonio area new construction homes and floorplans at ShowingNew.com/TrudyEdwards

** Percentage increases are based on a year-over-year comparison of July 2023 in comparison with July 2022. San Antonio market data provided by San Antonio Board of REALTORs.

San Antonio Home Prices Posted Increases in February Despite Dip in Home Sales

The San Antonio real estate market posted increases in average and median home prices in February despite a significant decline in the number of homes sold compared to February of last year, according to the Multiple Listing Service (MLS) Report from the San Antonio Board of REALTORS® (SABOR)

The higher interest rates since June 2022, have affected home buyers’ affordability, causing a significant decrease in the number of homes sold. However, with housing inventory still so low, home prices in the San Antonio area have continued to post year over year increases.

Average and Median Home Prices The average price of a home sold in the San Antonio area in February was $365,678, which is a 2% increase over February 2022. The median price homes sold for in February was $310,000 which is also a 2% increase over the February 2022 median price.

However, the number of single-family homes that sold in the San Antonio area in February was down 17% from the number of homes sold in February 2022 with 2,287 homes sold.

Average sold price per square foot in February was $176, which is the same as one year ago.

Days on Market – Single family homes in the San Antonio area stayed on the market for an average of 70 days in February. Homes stayed on the market 80% longer than in February 2022.

List Price to Sales Price Ratio – On average, homes sold for 93% of their original list price in February.

Condominium and Townhomes – The number of Condominium and townhomes sold in February was 29% lower than February 2022 with 51 units sold. The average sold price of condos and townhomes, at $247,322 was 5% percent higher than in February 2022. Condominiums and townhomes stayed on the market for an average of 60 days in February, which was 18% longer than condos stayed on the market in February 2022.

Housing Inventory – At the end of February, there was approximately 3.3 months of inventory available for sale in the San Antonio area.

With housing inventory increasing, home buyers are regaining some negotiating power. Even though it’s still a seller’s market, today buyers have less competition and more negotiating power.

If you are a home buyer contemplating a move but wondering how and why to buy a home amidst rising interest rates, here are a few things to consider.

While interest rates have increased from their historic lows, they are still far below where they have been in recent decades.

Financing Options for Affordability – Despite rising interest rates, there are many mortgage programs, builder promotions, down payment assistance programs and creative financing strategies available to help home buyers get into a home with a more affordable monthly payment. If you would like to learn more about down payment assistance programs and available financing options, contact your trusted mortgage lender or reach out to me for more information and recommendations for local lenders that can help match you to the best lending options for you.

While some homebuyers have been watching and waiting for prices to fall, waiting could be costly. If you are ready and able to buy a home now, it makes more sense to get into a home of your own, start building equity and net worth and enjoying the other benefits of being a homeowner.

As Odeta Kushi of First American stated, “If you can find a house that meets your financial expectations for a monthly payment and it’s a good time to buy, then do that…And if you wait for prices to fall, but they never do, you may discover the hard way that the house you found a year ago that you really loved that you could afford but you passed up on, is more expensive next year.”

If you are a home buyer, especially a first time home buyer looking to buy your first home and start building generational wealth, don’t lose hope, take action. Make sure that you are taking steps to manage your finances, improve your credit, stay informed and be ready to move forward when the opportunity arises.

In this real estate market it pays to make sure that you are informed about the local market, rates and options available to you to make smart financial moves. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

San Antonio Home Sales Slowed in August But Home Prices Still Rose By Double Digits

The San Antonio area continued to see an increase in average and median home prices in August, despite a decrease in the number of homes sold, according to the August 2022 Multiple Listing Service (MLS) Report from the San Antonio Board of REALTORS® (SABOR).

Average and Median Home Prices The average price of a home sold in the San Antonio area in August was $391,467, which is a 12% increase over August 2021 The median price homes sold for in August was $339,200, which is a 14% increase over the August 2021 median price.

However, the number of single-family homes that sold in the San Antonio area in August was 13% less than the number of homes sold in August 2021 with 3,272 homes sold, compared to the 3,776 that sold in August 2021 (twenty twenty one).

Average sold price per square foot was $188, which is percent 15% higher than in August 2021 twenty twenty one.

Inventory and Days on Market – In August, single family homes in the San Antonio area stayed on the market for an average of 30 days compared to an average of 24 days in August 2021, so homes stayed on the market 25% longer than one year ago.

The month of August ended with 9,570 listings on the market including 4,598 (four thousand, nine hundred ninety eight) new listings. The month ended with 3,067 sales pending.

Condominium and Townhomes – The number of Condominium and townhome sales was 10% lower than August 2021 with 81 units sold. The average sold price of condos and townhomes, at $210,709 was 3% lower than August 2021. Condominiums and townhomes stayed on the market for 60 days in August, compared to only 37 days one year ago, so condos and townhomes sold 62 percent slower than last August.

The San Antonio area had only 2.9 months of housing inventory available in August which is up slightly from the 2.7 months of inventory that was available in July. A supply of six months of inventory is considered to be a balanced market, so we are still in a Sellers’ market.

However, with housing inventory increasing, home buyers are regaining some negotiating power. Even though it’s still a seller’s market, it’s a more moderate sellers market than last year. Today buyers have less competition and more negotiating power as we are seeing less multiple offer situations than earlier in the year.

One of the reasons that home sales have slowed is that rising interest rates have impacted home buyer’s affordability. If that has been the case for you, let’s put things into perspective. While interest rates have increased from their historic lows, they are still far below where they have been in recent decades.

Home prices are predicted to continue increasing into 2023 just at a more moderate rate than they were in the last two years.

If you are a home buyer, especially a first time home buyer considering making a move, don’t lose hope. In addition to increasing inventory and buyer negotiating power, there are mortgage programs, down payment assistance programs and creative financing strategies available to help you to buy a home in this market.

If you are looking to buy your first home and start building generational wealth, make sure that you are taking steps to manage your finances, improve your credit, stay informed and be ready to move forward when the opportunity arises. Although interest rates seem high right now compared to the historic lows that were available in the last couple of years, they could climb higher still and home prices are predicted to keep rising, especially in the San Antonio area. The sooner that you can get into your own home and start building equity, the better.

In this real estate market, make sure that you are informed about the local market, mortgage interest rates and options available to you to make smart financial moves. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

*Percentage increases are based on a year-over-year comparison of August 2022 in comparison with August 2021. San Antonio market data provided by San Antonio Board of REALTORs

Will My House Still Sell in Today’s Market?

If recent headlines about the housing market cooling and buyer demand moderating have you worried you’ve missed your chance to sell, here’s what you need to know.

Buyer demand hasn’t disappeared, it’s just eased from the peak intensity we saw over the past two years.

Buyer Demand Then and Now

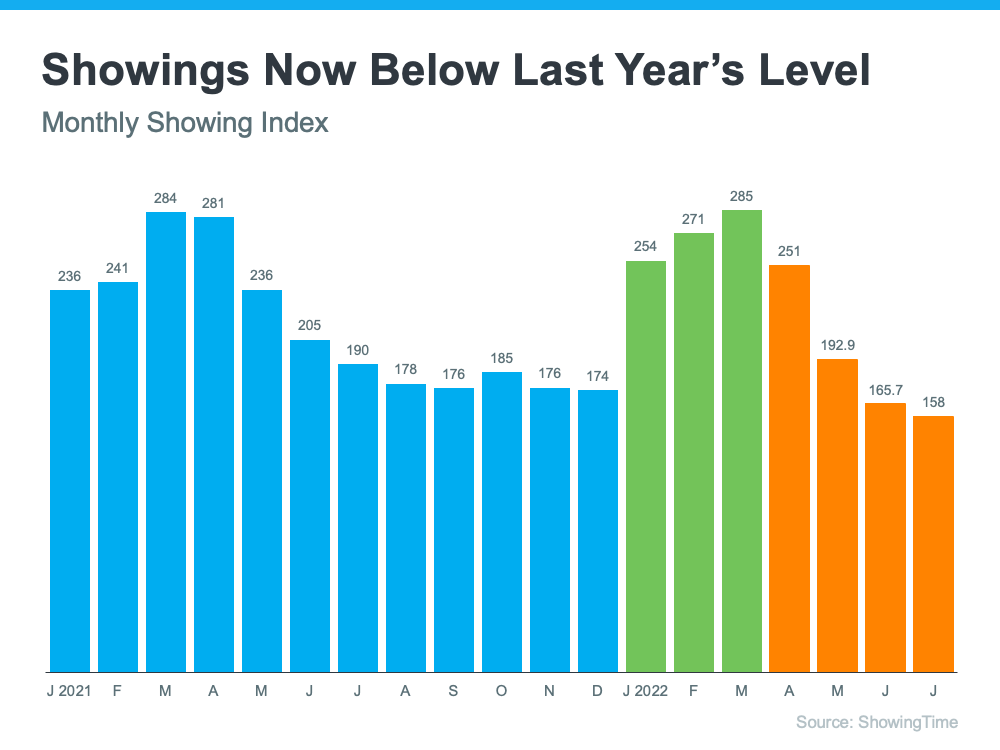

During the pandemic, mortgage rates hit record lows, and that spurred a significant rise in buyer demand. This year, as rates increased due to factors like rising inflation, buyer demand pulled back or softened as a result. The latest data from ShowingTime confirms this trend (see graph below):

The orange bars in the graph above represent the last few months of data and the clear cooldown in the volume of home showings the market has seen since mortgage rates started to rise. But context is important. To get the full picture of where today’s demand stands, let’s look at the July data for the past six years (see graph below):

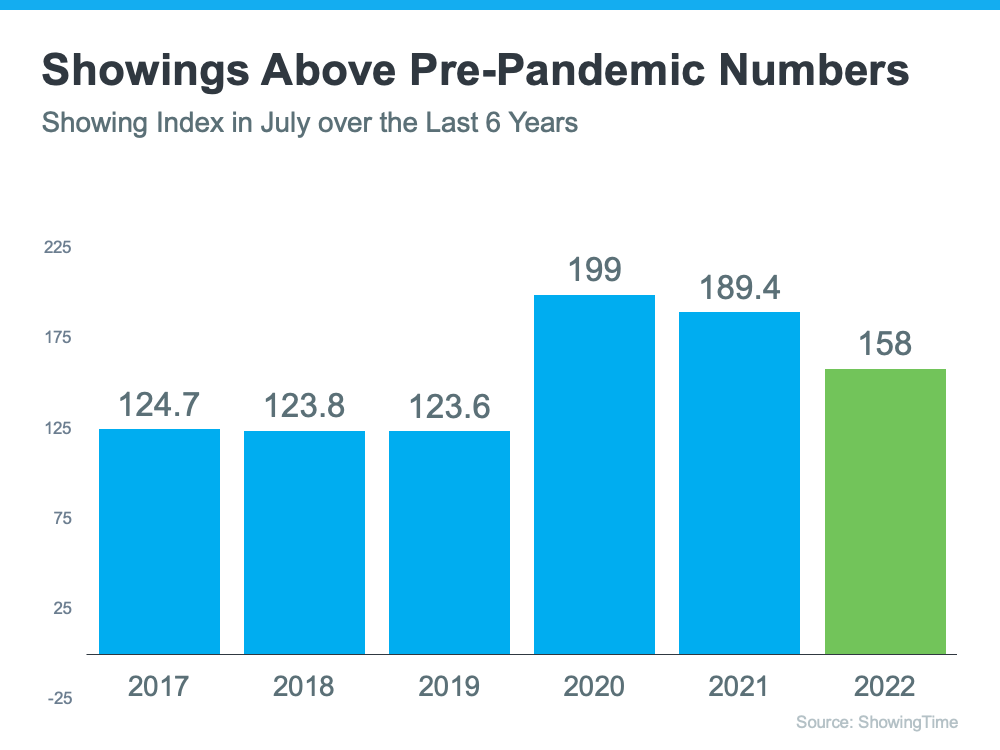

This second visual makes it clear that, while moderating compared to the frenzy in 2020 and 2021, showing activity is still beating pre-pandemic levels – and those pre-pandemic years were great years for the housing market. That goes to show there’s still demand if you sell your house today.

What That Means for You When You Sell

The key to selling in a changing market is understanding where the housing market is now. It’s not the same market we had last year or even earlier this year, but that doesn’t mean the opportunity to sell has passed.

While things have cooled a bit, it’s still a sellers’ market. If you work with a trusted local expert to price your house at the current market value, the demand is still there, and it should sell quickly. According to a recent survey from realtor.com, 92% of homeowners who sold in August reported being satisfied with the outcome of their sale.

Bottom Line

Buyer demand hasn’t disappeared, it’s just moderated this year. If you’re ready to sell your house today, let’s connect so you have expert insights on how the market has shifted and how to plan accordingly for your sale.

San Antonio Home Prices Still Rising, Despite Decrease in Sales

The San Antonio area continues to see an increase in average and median home prices, despite a decrease in the number of homes sold in July 2022 according to the Multiple Listing Service (MLS) Report from the San Antonio Board of REALTORS® (SABOR).

Average and Median Home Prices The average price of a home sold in the San Antonio area in July was $389,486, which is a 12% increase over July 2021. The median price homes sold for in July was $341,600, which is a 15% increase over the July 2021 median price.

However, the number of single-family homes that sold in the San Antonio area in July was 15% less than the number of homes sold in July 2021, with 3,333 homes sold, compared to the 3,910 that sold in July 2021.

Average sold price per square foot was $186, which is percent 35% higher than in July 2021.

Inventory and Days on Market – In July, single family homes in the San Antonio area stayed on the market for an average of only 27 days compared to an average of 25 days in July 2021, so homes stayed on the market 8% longer than one year ago.

The month of July ended with 9,068 listings on the market including 5,114 new listings. The month ended with 2,856 sales pending.

Condominium and Townhomes – The number of Condominium and townhome sales was 6% lower than July 2021 with 83 units sold. However, the average sold price of condos and townhomes, at $242,970 was 11% higher than July 2021. Condominiums and townhomes stayed on the market for only 15 days in July, compared to 44 days one year ago, so condos and townhomes sold percent 27% twenty seven percent faster than last March.

The San Antonio area had only 2.7 months of housing inventory available in July which is up slightly from the 2.3 months of inventory that was available in June. A supply of six months of inventory is considered to be a balanced market, so we are still in a very strong Sellers’ market.

The slight increase in number of homes for sale offers more choices for buyers and home sellers who are looking to sell a home and buy a home in the San Antonio area.

If you have been thinking of moving into the home of your dreams or downsize into something that better suits your current needs, you have an opportunity to get ahead of the curve by leveraging your growing equity and purchasing your next home before prices climb higher.

While home sales have slowed slightly, in reaction to recent interest rate increases, housing experts are not anticipating any declines in home prices. According to the latest forecasts, experts are confident prices will continue to appreciate this year, although at a more moderate rate than they did in 2021.

Residential Lots & Acreage – The number of residential lots and acreage properties sold in the San Antonio area in July was 34% lower than July 2021, with 299 lots sold compared to the 451 that sold in July 2021. However, the average price of lots increased to $158,723 a 12% increase compared to one year ago. Lots and acreage properties spent an average of only 73 days on the market in July, which is 39% less time on the market compared to the average of 120 days that they spent on the market than in July 2021.

Rural Farms and Ranches – The number of Rural Farms and Ranches sold in the San Antonio area in July was 24% lower than July 2021, with 41 farms and ranches sold compared to 54 sold one year ago. The average price of rural farm and ranch properties that sold was $1,232,880 which was 24% higher than the average price of farm and ranch properties that sold in July 2021.

If you are considering buying or selling a home, it pays to make sure that you are informed about the options available to you to make strong offers and smart financial moves. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.