Blog Archives

How Changing Mortgage Rates Affect Affordability

Posted by Trudy Edwards

The Best Way To Keep Track of Mortgage Rate Trends

If you’re thinking about buying a home, chances are you’ve got mortgage rates on your mind. You’ve heard about how they impact how much you can afford in your monthly mortgage payment, and you want to make sure you’re factoring that in as you plan your move.

The problem is, with all the headlines in the news about rates lately, it can be a bit overwhelming to sort through. Here’s a quick rundown of what you really need to know.

The Latest on Mortgage Rates

Rates have been volatile – that means they’re bouncing around a bit. And, you may be wondering, why? The answer is complicated because rates are affected by so many factors.

Things like what’s happening in the broader economy and the job market, the current inflation rate, decisions made by the Federal Reserve, and a whole lot more have an impact. Lately, all of those factors have come into play, and it’s caused the volatility we’ve seen. As Odeta Kushi, Deputy Chief Economist at First American, explains:

“Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

Professionals Can Help Make Sense of it All

While you could drill down into each of those things to really understand how they impact mortgage rates, that would be a lot of work. And when you’re already busy planning a move, taking on that much reading and research may feel a little overwhelming. Instead of spending your time on that, lean on the pros.

They coach people through market conditions all the time. They’ll focus on giving you a quick summary of any broader trends up or down, what experts say lies ahead, and how all of that impacts you.

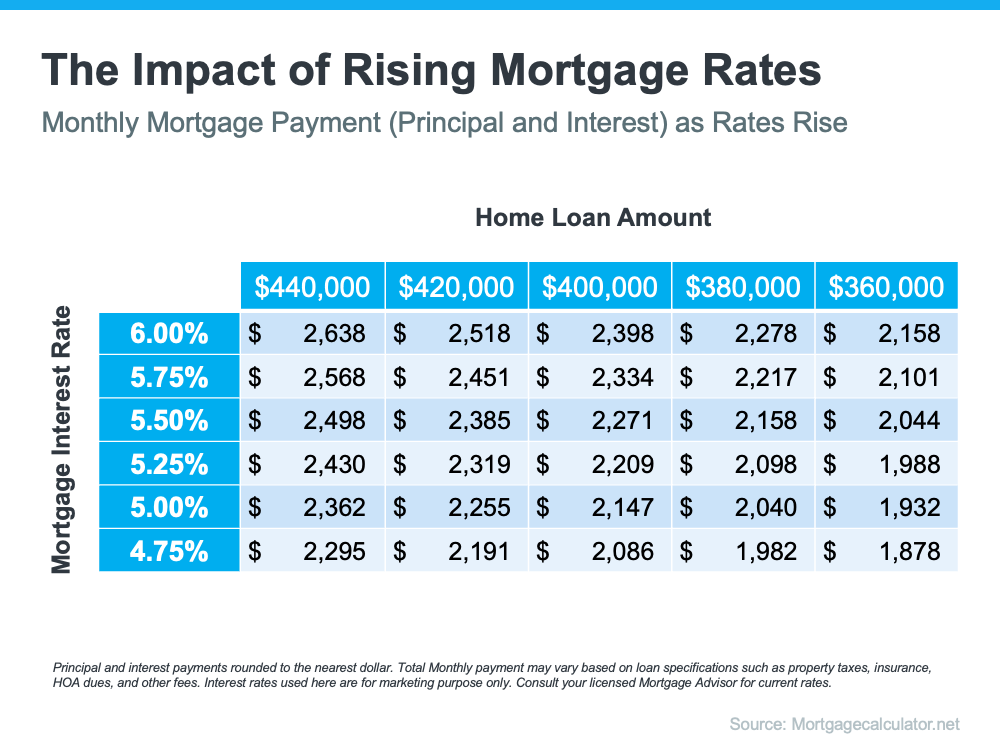

Take this chart as an example. It gives you an idea of how mortgage rates impact your monthly payment when you buy a home. Imagine being able to make a payment between $2,500 and $2,600 work for your budget (principal and interest only). The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

As you can see, even a small shift in rates can impact the loan amount you can afford if you want to stay within that target budget.

It’s tools and visuals like these that take everything that’s happening and show what it actually means for you. And only a pro has the knowledge and expertise needed to guide you through them.

You don’t need to be an expert on real estate or mortgage rates, you just need to have someone who is, by your side.

Bottom Line

Have questions about what’s going on in the San Antonio area housing market? Let’s connect so we can take what’s happening right now and figure out what it really means for you.

San Antonio New Construction Homes Boosted Inventory in May

Posted by Trudy Edwards

New Construction homes in the San Antonio area gave a significant boost to local housing inventory

Read more about this and other San Antonio area real estate data and trends in this market update with the stats and trends for May 2023.

Average and Median Home Prices: Average home prices in the San Antonio area remained unchanged in May, compared to May of last year, according to the Multiple Listing Service Report from the San Antonio Board of REALTORS. The average price of a home sold in May in the San Antonio area, at $388,593, was the same as May 2022. The median price homes sold for in May was $324,750 dollars, which is a 3% three percent decline compared to May 2022 median price.

Sales Volume: The number of single-family homes that sold in the San Antonio area in May was down 3% percent from the number of homes sold in May 2022, with 3,487 homes sold.

Price Per Square Foot: Average sold price per square foot in May was $182 , which was 2% lower than one year ago. Breaking that down further single family existing homes, sold for an average of $183 per square foot, which was a 1% decrease compared to last year, while single family new construction homes sold for an average of $181, which was 7% seven percent lower than in May 2022 twenty twenty two.

Average Days on Market: Single family homes in the San Antonio area stayed on the market for an average of 65 days in May, which was 141% longer than in May 2022, but five days less than the average of 70 days that homes were staying on the market in April.

On average, homes sold for 95.2% of their original list price in May, which was up almost one percent from April.

Condominiums & Townhomes: The number of Condominium and townhomes sold in May was 33% lower than May 2022, with 78 units sold. The average sold price of condos and townhomes, at $281,973 was 1% one percent lower than in May 2022. Condominiums and townhomes stayed on the market for an average of 53 days in May, which was 2% two percent longer than condos stayed on the market in May 2022.

Housing Inventory: At the end of May, there were approximately 3.7 months of inventory available for sale in the San Antonio area, which is up very slightly from the 3.3 months of inventory that was available in April. The number of new listings was down by 1% in May, with 4,575 new listings. There were 2,887 homes under contract at the end of May, which was down 14% from May 2022. At the end of May there were a total of 10,005 homes on the market in the San Antonio area, which was 81% percent higher than one year ago.

New Construction Inventory: A significant amount of new listing inventory in May the San Antonio area came from new construction homes. There were 1,337 new construction homes added to the inventory in May which is up 52% from May 2022.

Market Overview: Even though we are still in a seller’s market, we are moving toward more of a balanced market, and today buyers have less competition and are gaining negotiating power.

Interest Rates and Mortgages: If you are a home buyer contemplating a move but wondering how and why to buy a home today, here are a few things to consider. While interest rates have increased from their historic lows, they are still far below where they have been in recent decades.

If you are looking to buy a home there are many mortgage programs, builder promotions, down payment assistance programs and creative financing strategies available to help home buyers get into a home with a more affordable monthly payment. If you would like to learn more about down payment assistance programs and available options, contact your trusted mortgage lender or reach out to me for more information and recommendations for local lenders that can help match you to the best lending options for you.

Whether you are thinking of buying a new construction home, buying your first home, or selling your your current home, it pays to work with a trusted real estate professional with local market insights. If you are ready to make your next move in the San Antonio area, reach out today for a no obligation home buyer or seller consultation with Trudy Edwards, REALTOR with Keller Williams Heritage.

Browse San Antonio area new construction homes and floorplans at ShowingNew.com/TrudyEdwards

How To Approach Rising Mortgage Rates as a Buyer

Posted by Trudy Edwards

Interest rates are rising, so timing is more important than ever

In the last few weeks, the average 30-year fixed mortgage rate from Freddie Mac inched up to 5%. While that news may have you questioning the timing of your home search, the truth is, timing has never been more important. Even though you may be tempted to put your plans on hold in hopes that rates will fall, waiting will only cost you more. Mortgage rates are forecast to continue rising in the year ahead.

If you’re thinking of buying a home, here are a few things to keep in mind so you can succeed even as mortgage rates rise.

How Rising Mortgage Rates Impact You

Mortgage rates play a significant role in your home search. As rates go up, they impact how much you’ll pay in your monthly mortgage payment, which directly affects how much you can comfortably afford. Here’s an example of how even a quarter-point increase can have a big impact on your monthly payment (see chart below):

With mortgage rates on the rise, you’ve likely seen your purchasing power impacted already. Instead of delaying your plans, today’s rates should motivate you to purchase now before rates increase more. Use that motivation to energize your search and plan your next steps accordingly.

The best way to prepare is to work with a trusted real estate advisor now. An agent can connect you with a trusted lender, help you adjust your search based on your budget, and make sure you’re ready to act quickly when it’s time to make an offer.

Bottom Line

Serious buyers should approach rising rates as a motivating factor to buy sooner, not a reason to wait. Waiting will cost you more in the long run. Let’s connect today so you can better understand your budget and be prepared to buy your home even before rates climb higher.

San Antonio Area Home Buyer Demand Surged in May

Posted by Trudy Edwards

There was strong home demand for homes from San Antonio area homebuyers in May, leading to a significant increase in the number of homes sold

A total of 3,669 single family homes sold, a twenty 27% increase in the number of homes sold over May 2020, as reported by the San Antonio Board of REALTORS Multiple Listing Service Report. The average price of a home sold in the San Antonio area increased to $341,853, a 23% increase over May 2020. The median price homes sold for increased to $282,400, a 17% increase over the May 2020 median price.

Average price per square foot of homes that sold was $157 per square foot, which is 21% higher than in May 2020.

Condominium and townhome sales saw a dramatic increase in sales activity in May, with 112 units sold, which is a 173% increase over 41 units that sold in May 2020. The average price of condos and townhomes increased by 24% over May 2020 to $246,416.

The month of May ended with 4,403 listings on the market including 4,148 new listings. The month ended with 3,504 sales pending.

Single family homes stayed on the market for an average of only 33 days in May compared to an average of 63 days in May 2020, so homes sold 48% faster than one year ago. Homes that are ready to move in to, attractively presented and priced right are selling quickly in this market.

We are in a strong seller’s market in San Antonio right now with only 1.3 months of inventory available in May, which is up slightly from the 1.2 months that was available in April.

High buyer demand paired with very few houses for sale makes this the optimal time to sell for those who are ready to do so. Danielle Hale, Chief Economist at realtor.com, explains:

“For most sellers listing sooner rather than later could really pay off with less competition from other sellers and potentially a higher sales price… They’ll also avoid some big unknowns lurking later in the year, namely another possible surge in COVID cases, rising interest rates and the potential for more sellers to enter the market.”

Danielle Hale, Chief Economist at realtor.com,

While demand for single family homes is strong, rural residential lots and acreage have continued to see increased interest and sales since the start of the COVID-19 pandemic. May 2021 saw a 77% increase in the number of lots and acreage properties sold compared to May 2020, with 435 lots sold. The average price of lots increased by twenty seven percent 27% compared to one year ago. Lots and acreage spent an average of 167 days on the market in May 2020, which is 13% longer than the average of 148 days in May 2020.

Rural Farms and Ranches continued to see increased sales activity with 44 farms and ranches sold in May which is 63% more sales compared to the 27 that sold in May 2020. The average price of rural farm and ranch properties that sold was $1,173,831 which was 74% higher than the average price of farm and ranch properties that sold in May 2020.

If you are looking to sell a home or buy a home in the San Antonio area, or have questions about the current real estate market I am just a text, email, or phone call away!

Please like and subscribe to my YouTube channel to receive more helpful real estate content like this from Trudy Edwards, REALTOR with True SA Real Estate Team, Keller Williams Heritage.